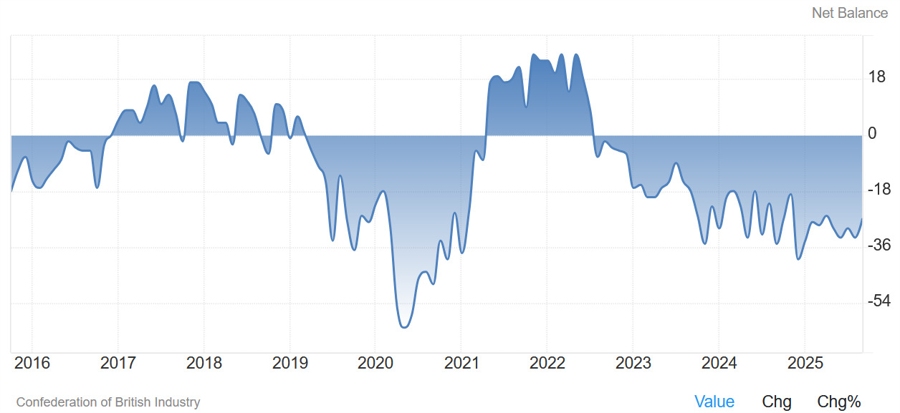

- Prior -33

This isn't a market-moving report but it's an improvement. Selling prices eased from +9 in August to +4 in September.

This isn't a market-moving report but it's an improvement. Selling prices eased from +9 in August to +4 in September.

Most Popular

WAT beats Q4 revenue, guides Q1 sales up 82%! But long-term growth & margins raise concerns.

MEDP beats Q4 revenue by 3.3% with 32% YoY growth, but stock dips 3.6%. Valuation check needed.

AMKR beats Q4 revenue by 3% ($1.89B) & guides higher, but inventory days rise.

UPWK beats EPS/EBITDA but guides lower next qtr. Stock drops 22.7%. ARPC up 9.8%.

AI giant Anthropic faces Indian lawsuit over name rights, seeking $110K damages. Court issues notice, no injunction yet.

China has reportedly told banks to curb US Treasury exposure, framing it as concentration-risk management. The USD softened and long yields were choppy, though markets expect any reduction to be gradual, not disruptive

CINF beats Q4 revenue by 5.8% ($3.09B) & EPS by 16.6% ($3.37). BVPS up 15.2% YoY.

Must Read