The dollar is firmer across the board as we are seeing it gain as risk sentiment begins to stumble. The late retreat in Wall Street yesterday was a mood changer and that is continuing to trading today. S&P 500 futures are now down 20 points, or 0.5%, with 10-year Treasury yields up another 2.5 bps to 3.89% - testing its December highs near 3.90%.

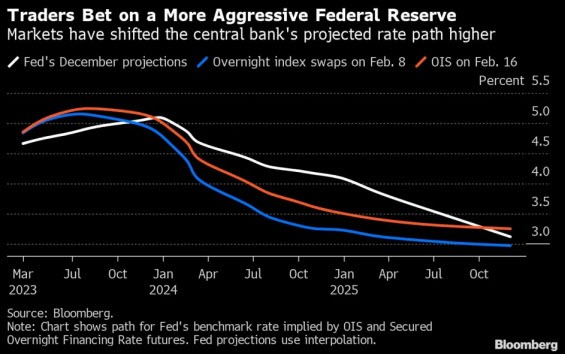

After some trepidation since the US CPI data on Tuesday, we are finally seeing markets stick to a more coherent theme. The terminal rate pricing for the Fed has also been bumped up to near 5.30% currently and that is reflective of the market moves we are seeing since US trading yesterday. The shift across the OIS curve is more prominent as seen below:

Looking ahead, UK retail sales will be a focus point for the pound and after two months of capitulation in consumer spending, another sot reading is expected in January (-0.3% m/m estimate). If that comes in at a miss, expect that to weigh further on the pound.

0700 GMT - Germany January PPI figures

0700 GMT - UK January retail sales data

0745 GMT - France January final CPI figures

0900 GMT - Eurozone December current account balance

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.