- Prior 50.8

- Manufacturing PMI 49.6 vs 46.6 expected

- Prior 46.2

- Composite PMI 51.1 vs 50.6 expected

- Prior 50.1

Key Findings:

- Faster rate of UK private sector output growth recorded in October, while cost inflation eases to 11-month low

Comment:

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

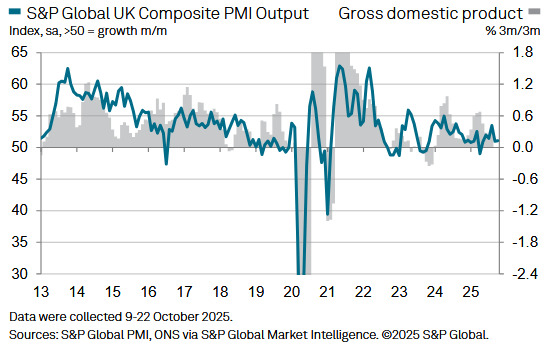

“October’s flash UK PMI survey brings hope that September was a low point for the economy from which business conditions are starting to improve. Output has picked up, with a particularly welcome return to growth for manufacturing for the first time in over a year accompanied by an upturn in demand for services, notably among consumers. Business confidence has also brightened slightly, job losses have moderated, and inflationary pressures are coming back to levels consistent with the Bank of England’s 2% target.

"However, even with a helping hand from restarted production at JLR, the overall pace of growth signalled by the PMI remains consistent with only sluggish GDP growth of around 0.1%. And, while easing, jobs continue to be cut amid a backdrop of business confidence that remains subdued by historical standards. Goods exports also continue to fall at a worryingly steep rate, in part due to the global trade disruptions caused by US tariff policy.

"Companies are clearly treading cautiously in terms of spending, investment and hiring ahead of the upcoming Budget, the outcome of which has the potential to once again sway the business mood in the months ahead."