- Prior 52.3

- Manufacturing PMI 50.2 vs 49.2 expected

- Prior 49.7

- Composite PMI 50.5 vs 51.8 expected

- Prior 52.2

Key Findings:

- UK private sector growth eases in November, while output price inflation softens to 59-month low

Comment:

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“November’s flash PMI surveys brought disappointing news on the UK economy. Economic growth has stalled, job losses have accelerated, and business confidence has deteriorated.

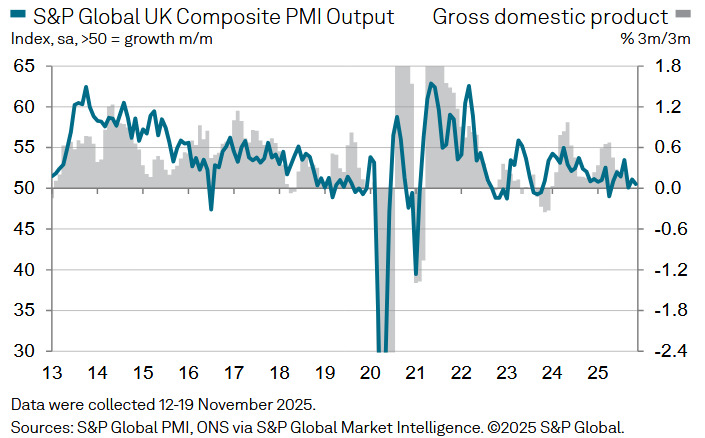

“The PMI is broadly consistent with no change in GDP in November and a meagre 0.1% quarterly pace of growth so far in the fourth quarter.

“Some of this malaise has been blamed on paused spending decisions ahead of the Autumn Budget, but there’s a real chance this pause may turn into a downturn. The drop in confidence about the year ahead reflects growing concerns that business conditions will remain tough in the coming months, largely linked to speculation that further demand- dampening measures will be introduced in the Budget.

“Concerns over the inflation outlook will meanwhile be further assuaged by a marked drop in selling price inflation to the lowest for nearly five years. Faced by weak demand and intensifying competition, firms are cutting prices to win sales. Prices charged for goods fell at the sharpest rate since 2016, and service providers are likewise reporting much-reduced pricing power. While this is good news for inflation, it’s bad news for business profits, hiring and investment.

“The PMI data therefore suggest the policy debate will shift further away from inflation worries toward the need to support the struggling economy, hence adding to the chances of interest rates being cut in December.”