- Prior 52.3

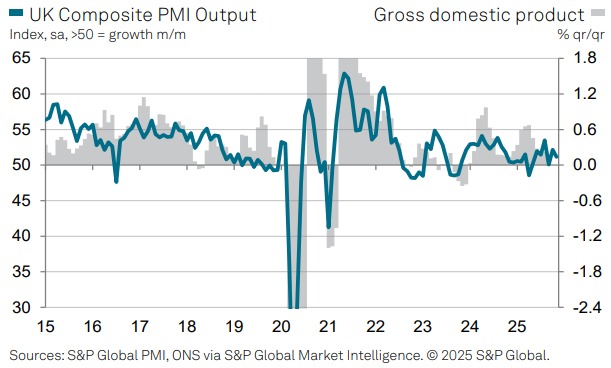

- Final Composite PMI 51.2 vs 50.5 prelim

- Prior 52.2

Key findings:

- Marginal expansion of business activity in November

- Fastest fall in employment since February

- Prices charged inflation lowest since January 2021

Comment:

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

"November data revealed an abrupt end to the steady improvement in order books seen since the summer. Unfavourable demand conditions were signalled in both domestic and export markets. Lower workloads led to a renewed slowdown in business activity growth across the UK service economy, with the latest expansion much softer than the post-pandemic trend. Moreover, staffing numbers were trimmed to the greatest extent since February.

"Survey respondents widely commented on business challenges linked to fragile client confidence, heightened risk aversion and elevated policy uncertainty in the run up to the Budget. Many firms noted that major spending decisions had been delayed, while some also cited long-term growth headwinds from subdued investment spending.

"Intensifying price competition at home and abroad, combined with weal sales pipelines, contributed to an erosion of margins across the service economy. Input cost inflation accelerated during November, mostly driven by higher salary payments, but prices charged by service sector firms increased at the slowest pace for nearly five years."