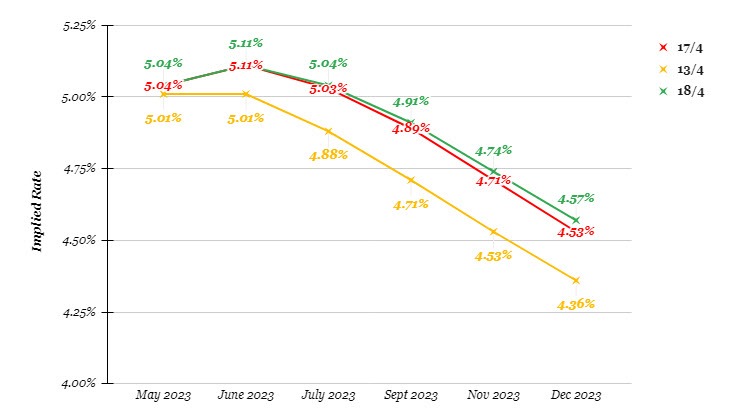

The dollar roared back in trading yesterday, moving higher after having been pushed to the edge at the end of trading last week. Higher bond yields is also playing a role, as markets are turning less dovish on the Fed outlook. I maintain that the Fed funds futures curve remains a key one to watch, in gauging the Fed's appetite to stick to its higher for longer narrative.

As you can see, higher rates are now being priced back towards the end of the year. There are now roughly two rate cuts priced in by year-end as opposed to three on Thursday last week.

Looking ahead, Europe will once again be left to its own devices to sort out the above sentiment as well as the risk mood - which is looking rather tentative so far.

The UK jobs report should just reaffirm that the labour market is holding up but keep an eye out on wages, which should reflect some early signs of easing. That might help the BOE's case to pause soon enough, if accompanied by a softer set of inflation numbers later this week.

0600 GMT - UK March payrolls change

0600 GMT - UK February ILO unemployment rate, employment change

0600 GMT - UK February average weekly earnings

0900 GMT - Germany April ZEW survey current conditions, economic sentiment

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.