- Prior 51.4

- Manufacturing PMI 51.6 vs 50.6 expected

- Prior 50.6

- Composite PMI 53.9 vs 51.5 expected

- Prior 51.4

- Full report here

Key Findings:

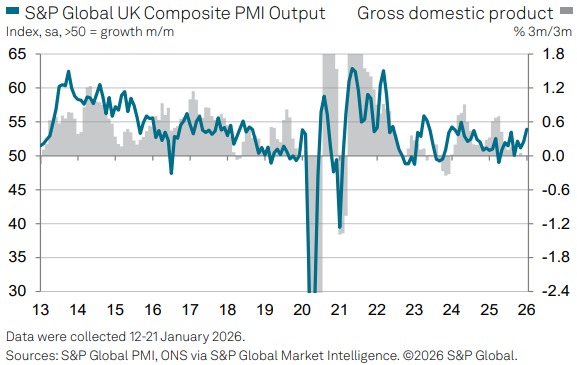

- Strongest upturn in UK private sector business activity since April 2024

Comment:

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“UK businesses kicked up a gear in January, showing encouraging resilience in the face of recent geopolitical tensions. Companies are reporting higher demand, both from home and export markets, which has driven output growth to the fastest since April 2024. Firms are also reporting the greatest optimism about the business outlook since before the 2024 Autumn Budget.

"The January flash PMI is up to a level indicative of a robust quarterly GDP growth approaching 0.4%. While growth continues to be driven by the service sector, and in particular financial services and tech, the manufacturing sector is also continuing to report a gathering recovery aided by resurgent demand, with goods exports notably rising for the first time in four years.

"The good news was tempered, however, by the upturn in order books failing to stem a steep loss of jobs, which companies commonly blamed on the need to reduce high costs. These cost pressures were again often linked to government policies relating to higher National Insurance contributions and the National Minimum Wage, and led to an especially steep drop in hospitality jobs.

"High staffing costs were meanwhile again widely reported as a key cause of higher selling prices, hinting at an intensification of price pressures at a level above the Bank of England target.”