- Prior 51.4

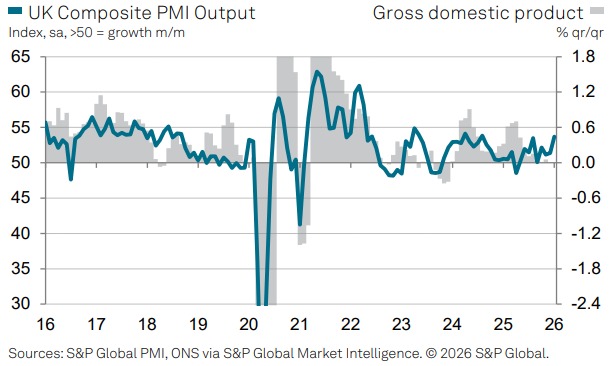

- Final Composite PMI 53.7 vs 53.9 prelim

- Prior 51.4

Key findings:

- Output growth rebounds to a five-month high

- Solid increase in new work

- Job losses continue, despite improved business optimism

Comment:

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

"The latest survey revealed an encouraging start to 2026 for the UK service sector, following a sluggish end to last year. Output growth was the fastest for five months, supported by an uplift in investment sentiment and greater new order intakes. A number of firms suggested that post-Budget clarity had contributed to a broader improvement in client confidence, while some also cited rising export sales.

"Despite a recovery in total new work, service providers still reported that consumer demand was constrained by squeezed disposable incomes, while risk aversion in response to geopolitical tensions was a factor holding back business spending.

"Service sector companies appear cautiously optimistic about their growth prospects for the next 12 months, with confidence the highest seen since October 2024. However, there were again gloomy signals for the UK labour market outlook as staff hiring decreased at a steeper pace in January as firms looked to offset rising payroll costs. Another sharp increase in overall input prices contributed to the fastest rate of output charge inflation for five months."