- Final Services PMI 50.8 vs 51.2 expected and 51.1 prior.

- Final Composite PMI 50.6 vs 50.9 expected and 50.4 prior.

Key Findings:

- Renewed downturn in order books

- Marginal output growth in January

- Fastest reduction in employment for four years

Comment:

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

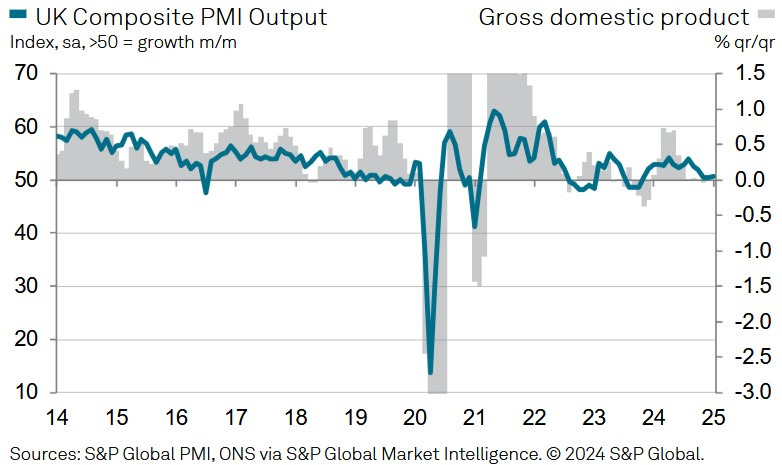

"January data highlighted a challenging business environment for UK service providers as stagflation conditions appeared to take a firmer hold at the start of the year. Output levels increased only marginally, while input cost inflation accelerated for the fifth month in a row to its highest since April 2024. Businesses widely noted sharply rising salary payments and many also felt the impact of suppliers passing on forthcoming increases in employers' national insurance contributions.

"A renewed downturn in new business volumes added to signs that the near-term UK economic outlook remains tilted to the downside. Service providers typically cited risk aversion among clients and subsequent cutbacks to investment plans, albeit with resilient spending continuing in areas such as technology services.

"Business activity expectations for the year ahead weakened in response to subdued demand in January, with optimism now the lowest since December 2022. A range of growth headwinds at home and abroad were cited by survey respondents, including elevated interest rates, geopolitical uncertainty and a post-Budget slide in domestic business confidence.

"The twin perils of shrinking workloads and rising payroll costs meant that many service providers put the brakes on recruitment in January. As a result, total employment numbers across the service economy decreased to the greatest extent for four years. Job cuts were seen in most sub-sectors, with leisure and hospitality businesses indicating a particularly sharp rate of decline."