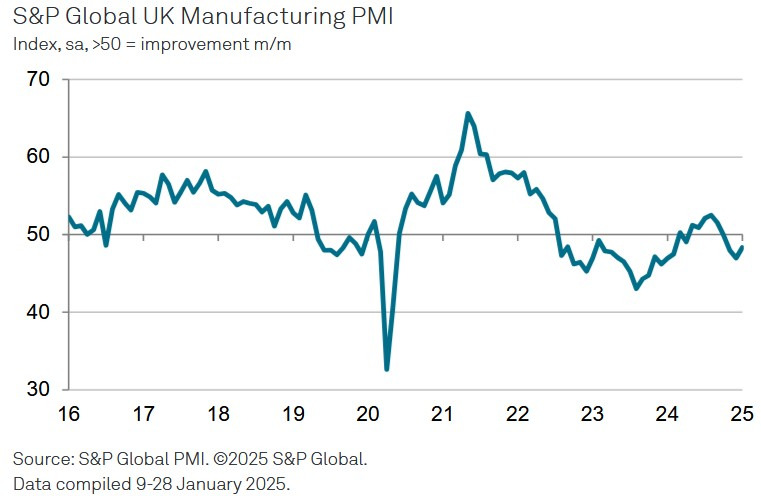

- Prior was 47.0

Key Findings:

- Output, new orders and employment all contract further

- Input price inflation hits two-year high

Comment:

Rob Dobson, Director at S&P Global Market Intelligence:

“The start of 2025 has seen the downturn in the UK manufacturing sector continue. Factory output, new orders and employment all fell further in January as companies faced weak market demand, rising costs and a deteriorating outlook."

"The latest survey also suggests that this retrenchment is being hardest felt among small companies. Large- sized manufacturers fared better, seeing output and new orders recover during January."

"There nevertheless seems little scope for any imminent improvement in performance across the board. Demand conditions remain weak in both domestic and overseas markets, cost pressures are rising and will likely continue to do so as changes to the minimum wage and employer NI announced in last year's Budget feed through."

"Business optimism consequently remains close to December's two-year low, while input price inflation has spiked to a two-year high. A stagnant economy and rising cost burdens leave policy makers with a real dilemma, balancing the need for rate cuts to support flagging growth and a declining labour market against the need to contain inflationary pressures."