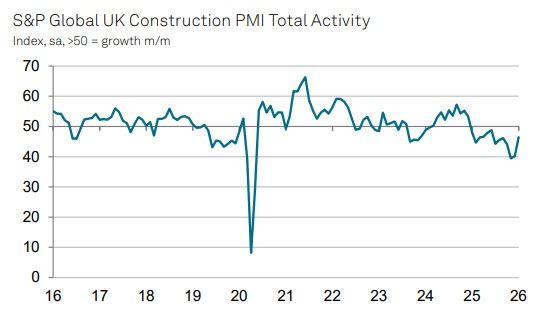

- Prior 40.1

That's a modest uptick in UK construction activity, with this being the slowest reduction in seven months. All three sub-sectors recorded weaker rates of contraction than those seen in December, helped by a more stable demand environment and reports of a gradual turnaround in sales pipelines.

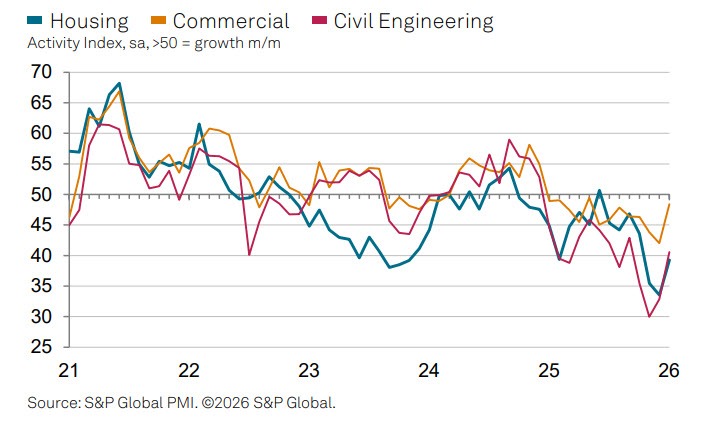

House building (39.3) was the weakest-performing segment to start the year while civil engineering (40.6) also decreased at a sharp pace in January. Meanwhile, the contraction in commercial work (48.4) was the slowest since May last year at least.

S&P Global notes that:

"January data provided encouraging signs that the UK construction sector has exited its tailspin, and firms are becoming more hopeful that new projects will get back on track in 2026.

"The latest reduction in total industry activity was the slowest since last June. Commercial work outperformed, with activity moving close to stabilisation amid a postBudget boost to contract awards. House building weakness persisted, although even here the rate of decline eased considerably since December and was the least marked for three months.

"Construction companies noted subdued underlying demand due to fragile client confidence and elevated risk aversion, but there were some reports of improving investment sentiment and greater sales enquiries at the start of the year. As a result, business activity expectations rebounded to an eight-month high, while the pace of job losses moderated.

"Supply conditions improved again in January. Lead times for the delivery of construction items shortened for the sixth month in a row and subcontractor availability increased at a solid pace. However, margins were under pressure as higher wages and raw material prices led to the sharpest rise in purchasing costs since September 2025."