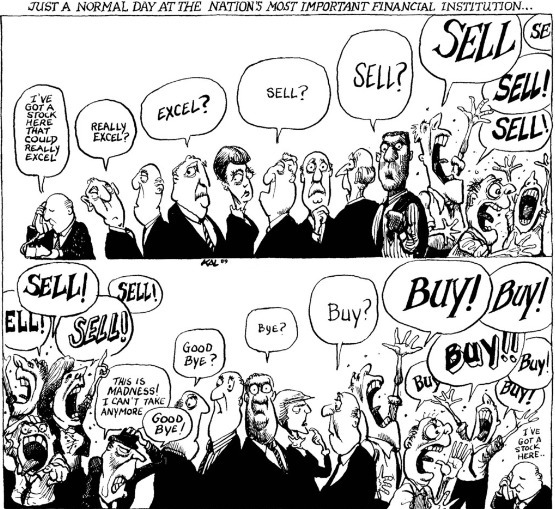

Markets are heeding caution after the US CPI data release yesterday but not without drama as we saw plenty of twisting and turning in US trading yesterday. It wasn't a straightforward report for market players to digest and I shared some thoughts on why that is the case here. Classic market reaction, eh?

For now, equities are slightly lower with S&P 500 futures seen down 0.4%. Meanwhile, the dollar is holding slightly higher going into European trading as traders look to sort out their feet and contest the technical levels outlined here yesterday. As things stand, almost all the key technical levels pointed out are still very much in play so essentially yesterday's main event didn't change anything.

Looking ahead, we'll get more key data releases today starting with UK CPI for January. The headline annual inflation figure is estimated to keep above 10% and that will continue to heap pressure on the BOE to keep tightening policy for now, with the core annual inflation reading estimated to ease slightly from 6.3% in December to 6.2% last month.

All that before the next round of drama that will stem from the US retail sales report at 1330 GMT.

0700 GMT - UK January CPI figures

0800 GMT - Spain January final CPI figures

1000 GMT - Eurozone December trade balance data

1000 GMT - Eurozone December industrial production

1200 GMT - US MBA mortgage applications w.e. 10 February

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.