- Prior 54.0

- Manufacturing PMI 52.0 vs 51.5 expected

- Prior 51.8

- Composite PMI 53.9 vs 53.2 expected

- Prior 53.7

Key Findings:

- Rebound in UK private sector business activity continues in February, but job losses persist

Comment:

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

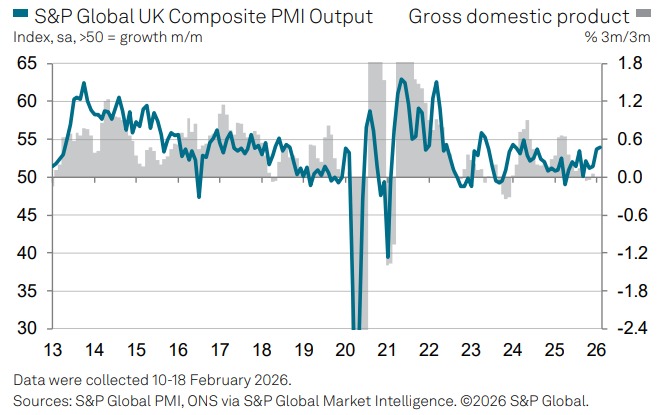

“The early PMI data for February bring further signs of an encouraging start to the year for the UK economy. A solid rise in output across manufacturing and services has been reported in both January and February, with the rate of expansion gaining pace. The survey data so far this year are consistent with GDP rising by just over 0.3% in the first quarter if this performance is sustained into March.

“The upturn continues to be led by the service sector but there are signs that manufacturing is regaining momentum to join in the recovery, reporting a surge in export orders of a magnitude not seen since the pandemic.

“Despite enjoying higher demand for goods and services, companies remain focused on boosting productivity to cut costs, resulting in yet another month of steep job losses to prolong the continual jobs downturn that was initiated by the 2024 autumn Budget.

“Higher staffing costs, often attributed to Budget policy changes, meant service sector inflation remained elevated. However, increased competition, especially in the manufacturing sector, is helping keep a lid on inflationary pressures.

“Bank of England policymakers will be encouraged by the indications of stronger economic growth, but the relatively modest price pressures being signalled and ongoing worrying labour market weakness will likely result in a growing call for further rate cuts.”