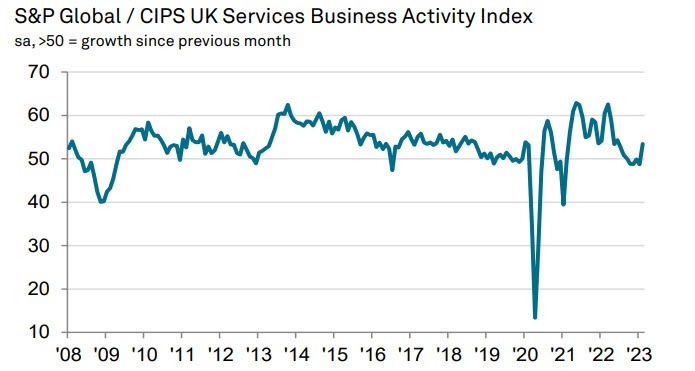

- Composite PMI 53.1 vs 53.0 prelim

Output levels rise for first time in six months as new order growth hits a 9-month high, reaffirming a modest pick up in the UK economy in February. S&P Global notes that:

"UK service providers moved back into expansion mode in February as fading recession fears and improving business confidence resulted in the strongest rise in new orders since May 2022. However, elevated borrowing costs and stretched household finances remained constraints on growth.

"There was clear evidence that input price inflation has peaked, with the latest increase in average cost burdens the weakest since June 2021. Service sector firms commented on lower fuel bills and transportation costs, alongside a gradual easing of broader inflationary pressures due to falling wholesale gas prices. However, many businesses also noted historically strong wage inflation and sharply rising food costs, especially those operating in the hotels and restaurants sector.

"Tight labour market conditions and the need to alleviate squeezed margins continued to limit the degree to which falling cost pressures were passed on to end consumers. The index measuring average prices charged by service sector companies has fallen by just 0.2 points over the past three months, compared to 5.9 points for input prices, which adds to signs of sticky inflationary pressures.

"Service providers appear confident that demand remains sufficiently resilient to pass on higher costs to clients. The latest survey indicated that business activity expectations rebounded to highest since March 2022, helped by reduced political uncertainty, an improving global economic outlook, and hopes that peak interest rates are on the horizon."