- Prior 51.3

- Final Composite PMI 51.4 vs 52.1 prelim

- Prior 51.2

Key findings:

- Business activity expansion remains marginal

- Renewed upturn in new orders

- Input cost inflation accelerates to seven-month high

Comment:

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

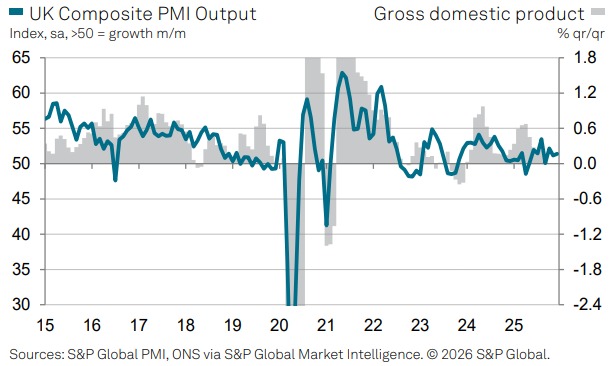

"Lacklustre business activity growth continued across the UK service sector at the end of 2025. Moreover, the speed of expansion was softer than signalled by the earlier 'flash' survey in December and lower than seen on average in the second half of the year.

"The most positive development was a renewed upturn in new business intakes, following a slight decline during November. Modest growth of incoming new work was attributed to tentative signs of a recovery in client confidence after an extended period of pre-Budget gloom. Order books were also supported by a marginal rebound in export sales.

"However, survey respondents still noted sales headwinds linked to weak UK economic prospects, alongside challenging operating conditions due to factors such as sharply rising business costs and soft demand in major overseas markets. Worries about squeezed margins and broader growth prospects contributed to another marked reduction in service sector employment during December.

"Meanwhile, inflationary pressures across the service economy strengthened at the end of the year. Input prices rose to the greatest extent for seven months, and output charge inflation rebounded from November's recent low, despite the subdued demand backdrop."