- Prior 51.8

- Manufacturing PMI 47.3 vs 48.3 expected

- Prior 48.0

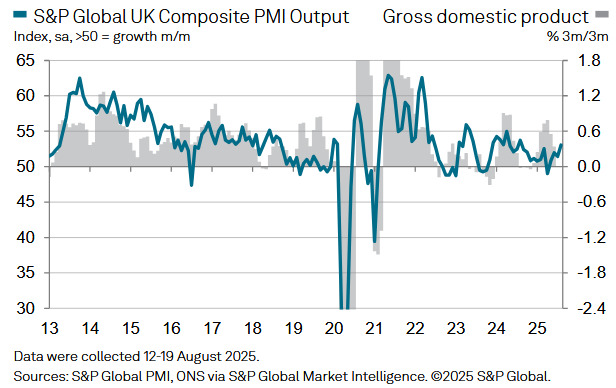

- Composite PMI 53.0 vs 51.6 expected

- Prior 51.5

Key Findings:

- Strongest rise in UK private sector business activity since August 2024

Comment:

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

“The flash UK PMI survey for August indicated that the pace of economic growth has continued to accelerate over the summer after a sluggish spring, the rate of expansion now at a one-year high. The services sector has led the expansion, but manufacturing also showed further signs of stabilising.

"It’s evident from survey measures of order books, however, that the demand environment remains both uneven and fragile. Companies report concerns over the impact of recent government policy changes, as well as unease emanating from broader geopolitical uncertainty. Goods exports are still falling especially sharply.

"Payroll numbers also continue to be cut at an aggressive rate by historical standards as firms cite weak order books and concerns over rising staff costs due to the policies announced in the autumn Budget, which also contributed to persistent inflation pressures.

"While the rise in business activity signalled by the PMI alongside the uplift in inflation to 3.8% in July lower the chances of further rate cuts this year, more data are required to assess both the sustainability of robust economic growth as well as the stickiness of the upturn in price pressures. Among a divided Bank of England rate setting committee, the perceived need for any future rate cuts will be very much data dependent."