- Prior 51.8

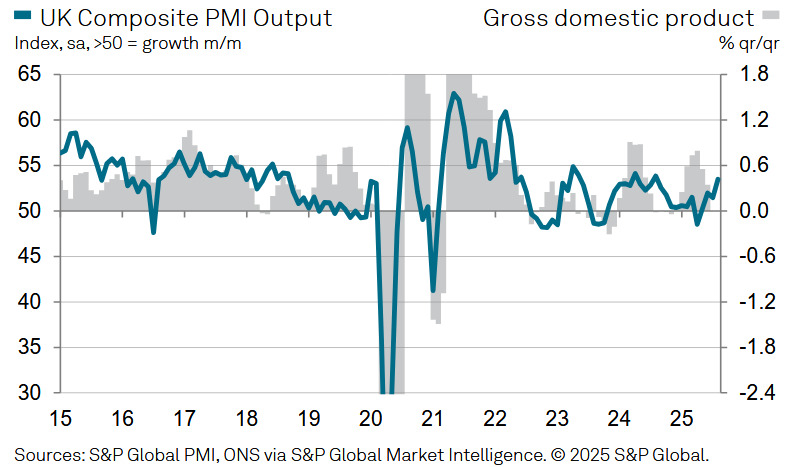

- Final Composite PMI 53.5 vs 53.0 prelim

- Prior 51.5

Key findings:

- Output growth accelerates during

- August Rebound in new order intakes

- Business optimism rises to a 10-month high

Comment:

Tim Moore, Economics Director at S&P Global Market Intelligence, said:

"August data highlights a welcome acceleration of output growth and a swift rebound in order books after July's dip, leaving the UK service economy on a much stronger footing as the end of summer comes into view.

"The seasonally adjusted New Orders Index rose by over six points in August, which was the largest one-month gain since March 2021 and indicative of a decisive improvement in customer demand. This was helped by greater domestic business and consumer spending, alongside the first increase in export sales since March.

"Hiring trends remained subdued in comparison to those seen for business activity and new order intakes. Total workforce numbers have decreased in each month since October 2024, with elevated payroll costs again cited as holding back recruitment. Some firms also reported a focus on automation and investments in productivity improvements to help alleviate margin pressures.

"Business activity expectations meanwhile hit a ten- month high in August, providing a clear signal that growth prospects for the UK service economy have moved up from the lows seen this spring. Improved sales pipelines, lower borrowing costs and receding fears about US tariffs all helped to boost business optimism. However, many service providers still commented on elevated government policy uncertainty and worries about forthcoming tax-raising measures expected in the autumn Budget."