This is a strong signal from the market.

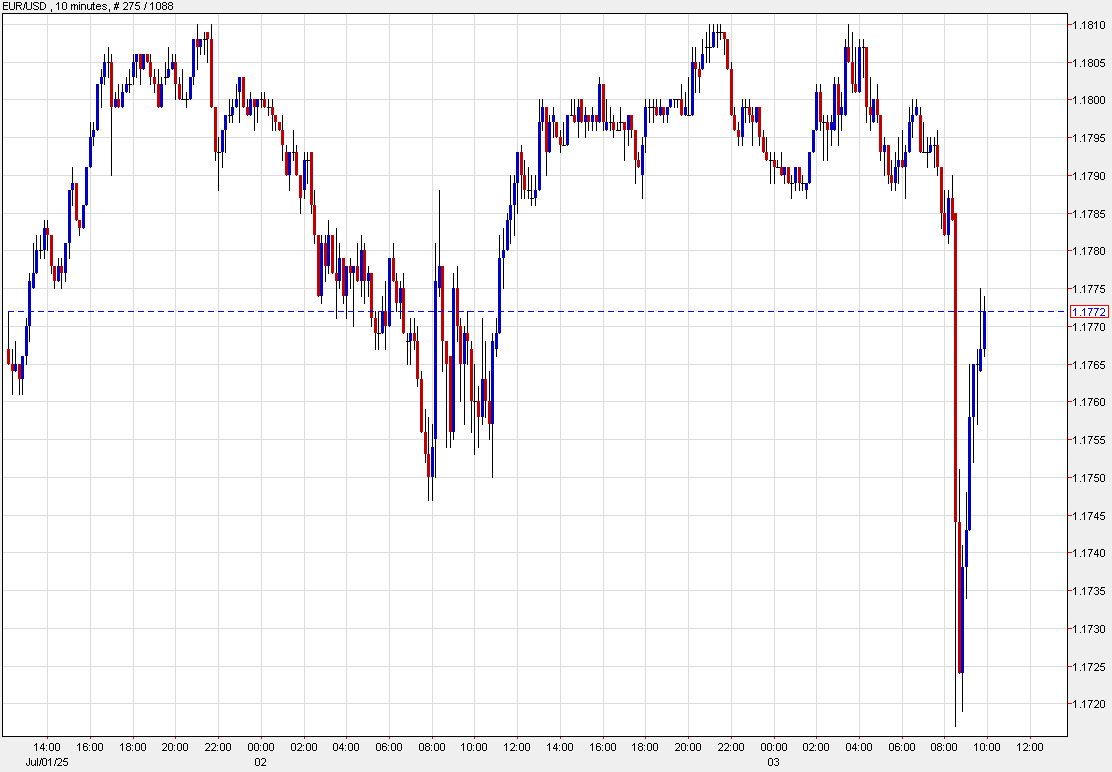

The US dollar leaped higher on the stronger non-farm payrolls report, climbing 40-100 pips across the board. The peak in those moves came immediately after the report and have now largely reversed despite the Fed funds curve continuing to reprice. Year-end Fed funds futures show 52 bps in easing compared to 62 bps beforehand. Two-year yields remain up 9 bps.

The dollar selling doesn't appear to be related to rate differentials or carry but by a desire to get out of US dollars, which have been structurally built up for a decade. The biggest trend we saw in the first half of the year was US dollar selling and this quick move to buy the dip in the euro and others is an argument for why that trend hasn't ended.