The oil market is about to get interesting.

Crude prices are higher today but haven't been able to recover from last week's drop -- which started on rumors of an OPEC+ production increase. The rumors turned out to be true as 137K bpd will hit the market next month.

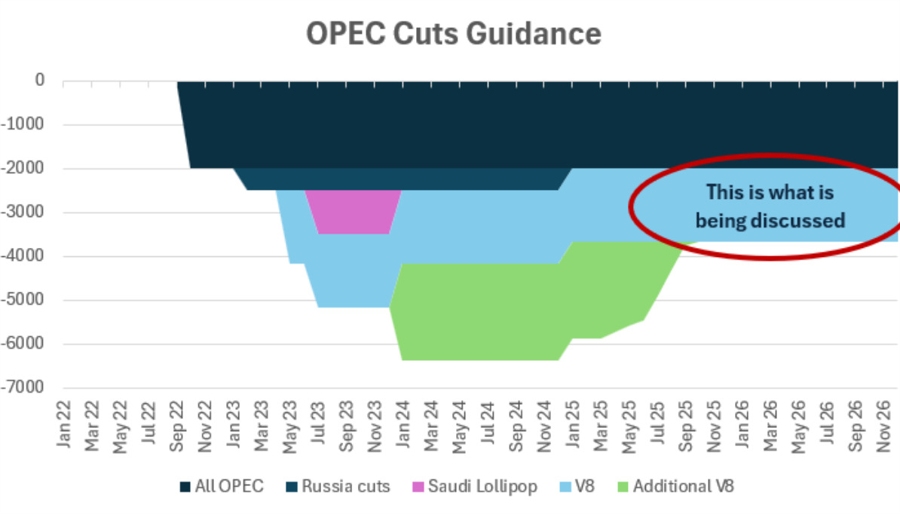

Worse yet, that pace of adding barrels is likely to continue until the full voluntary cuts are upwound (or possibly more than that beyond). This is a good graphic showing spare capacity.

Looking at the chart of crude, it's in a precarious place. The bottom end of the recent range didn't hold and we saw intraday selling yesterday and today. Support at $60 will probably need to be tested and if that breaks we could be back to the Liberation Day extremes, similar to what we saw in 2-year yields this week.

So far the resilience of oil has been impressive but there is talk of Chinese stockpiling. That won't last forever and we could be headed for an ugly breakdown.

It could also be a big opportunity. $55 oil is simply not sustainable. Exploration spending is already bombed out at around $10 billion per year globally (or about 12 hours of AI capex spending) and it will worsen with lower prices. In addition, US shale basis are running out of Tier 1 inventory and dropping new drilling.

That sets up a period in late 2026 or in 2027 when the market is undersupplied and OPEC has virtually no spare capacity. That's when it really gets interesting.