It's not a proper investing theme until there is an acronym.

I've been writing for a few weeks about old economy stocks making a comeback but it's been tough to frame exactly the kinds of companies that are best built for what's coming.

The market is frightened by disruption and that's why software stocks have seen a massive re-rating lower, with many falling 30-50% in a few weeks. There's a cottage industry developing in commentating on which software companies will actually be disrupted by AI but to me, it's tough to say in the software and tech space as the essential function of AI is intelligence and all these white collar companies are powered by brains not steel.

In contrast, money has flowed into sectors and companies that won't be disrupted by AI. I like the framing of HALO from Compound Advisors, which stands for Heavy Assets, Low Obsolescence.

The asset part is self-explanatory and the 'low obsolescence' means that they can't be disrupted by AI. Here are a few names they highlight:

Phillips 66 and Corning and Applied Materials and Vulcan Materials and Delta and Caterpillar and Ventas and Hershey may have very little to do with each other based on conventional GICS classification. But in my classification system, updated for today, they are all HALO

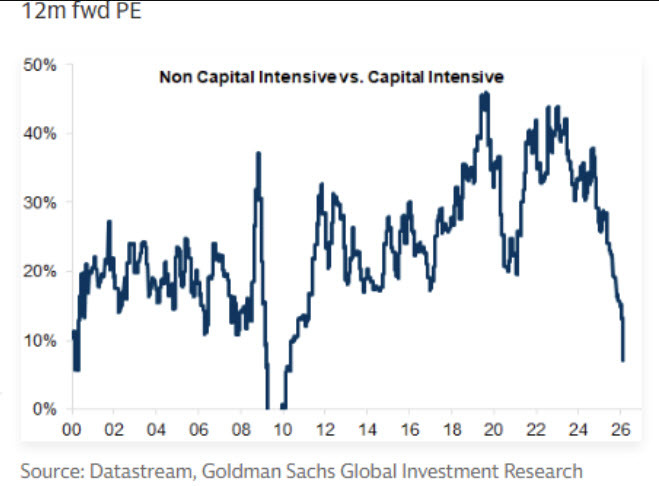

In the past, the market liked asset light models because they required less debt and had better margins. When you layer growth onto that, it results in supercharged profitability. That's led to 30-50x multiples in a crowded space but is quickly reversing as disruption is priced in.

Asset heavy companies have been slow to grow because of huge capital requirements but since we're in a rate cutting cycle, that debt is less burdensome and that could be durable in an era of structurally high unemployment. It also means that the companies are virtually impossible to disrupt -- no one is building a new coast-to-coast railway.

In addition (and I've made this point before), venture capital for the past 15 years has been so focused on tech and software that there is no money or expertise for developing startup heavy asset firms. The VC desert is the new moat.

But that's not all. The low margin nature of these businesses has always been a drag on multiples but now I think it's an opportunity. These companies can't really be disrupted by AI but they can benefit from it.

Picture a company with a $10 billion asset base with revenues of $2 billion and 3% margins. Think utilities, pipelines, ports, commodity producers, railways, airlines and refineries. The opportunity with AI is to improve efficiency. Even boosting margins by 1 percentage point in these companies can be a huge lift to profitability and cash generation. I would particularly look at companies with high employee counts or a high reliance on consultants/sub-contractors that can be trimmed.

For these companies, AI is an optimization tool. If an airline can squeeze 2% fuel savings routing, dispatch, and operations then it's not revolutionary but it's a tailwind. If a refinery can optimize the fuel mix, monitor operations or better schedule downtime, it's meaningful.

A SaaS company running 40% margins doesn't have much fat to optimize. But a pipeline operator or airline running 2-5% margins has enormous operational surface area where small AI-driven efficiencies compound into meaningful earnings growth.That's why I prefer to focus on the low margin aspect.

I would rather call them HALM -- High Assets Low Margin -- but that's not as catchy.

I like the framing of CNBC's Mike Santoli yesterday who talked about eye-watering capex from companies like Microsoft, Meta, Alphabet and OpenAI:

"The hyperscalers are spending $700 billion. That better be killing something or what are we doing here?"

How about this? Tangible Assets, Not Killable or TANK stocks.

Or maybe MOAT stocks: Massive Operations, Asset-Thick.

How about RAMP: Real Assets, Margin Potential.

In any case, you get the idea.