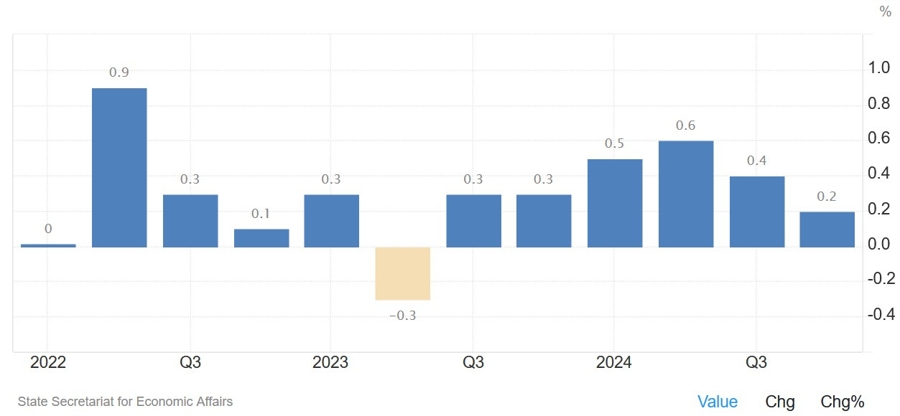

- Prior was +0.4%

- GDP Y/Y +1.5% vs +1.6% expected

- Prior was +2.0%; revised to 1.9%

Growth was driven roughly equally by industry and the services sector. On the expenditure side, both consumption and investment provided a positive impulse.

Growth was driven roughly equally by industry and the services sector. On the expenditure side, both consumption and investment provided a positive impulse.

Most Popular

Sponsored

Sugar futures climb! March '26 contract up 0.26 to 15.04, volume strong. Traders eye upward trend.

Tesla (+8.1%) and Rivian (+2.7%) lead Nasdaq movers. Broadcom (-9.5%) and NVIDIA (-0.3%) see mixed action. Traders eye valuations.

Lumber futures rise! Jan '26 contract up $4.50 to $561.00. Traders eye volume shifts.

KYTX surges 108% YTD, analysts see 208% upside. JANX down 70%, but 329% upside seen. Both 'Strong Buy' rated.

MSTR shares down 50%, but $1.4B cash reserve praised. Digital asset treasuries face mNAV < 1, some selling ETH to buy back shares.

Gold futures rally $60+ across contracts, with Feb '26 hitting $4375. Volume shifts as open interest climbs.

Corn futures show mixed signals: Dec '25 up 1.75, but Mar '26 down 1.25. Watch volume shifts!

Sponsored

Must Read