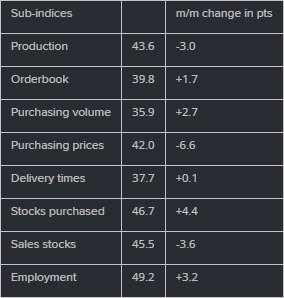

This just marks a small improvement in Swiss manufacturing activity, which is still in contraction at the end of last year. Output remains subdued, so any stark recovery is still left wanting coming into this year. Here's the breakdown:

This just marks a small improvement in Swiss manufacturing activity, which is still in contraction at the end of last year. Output remains subdued, so any stark recovery is still left wanting coming into this year. Here's the breakdown:

Most Popular

Futures climb as banks & tech rally! AMD hits buy point on AI surge. Wall Street wraps volatile week higher.

Asian tech stocks surge on AI hype & TSMC earnings! Dollar strengthens as Fed rate cut bets recede. Watch for China GDP.

Germany's defense spending surge (3.5% GDP by 2029) boosts orders >50% & GDP by 0.8%. Eurozone eyes 1.3% growth.

TSMC's 4.4% US gain fuels AI rally; Nvidia & BlackRock surge on strong demand & earnings.

TSMC's 4.4% US gain fuels AI rally; Nvidia & BlackRock surge on strong demand & earnings.

WTI Oil dives 3% as Iran tensions ease, Brent follows. Traders eye fading risk premium and potential downside.

AI spending to hit $2.53T by 2026! NVDA, GOOGL, META poised for growth as tech supercycle accelerates. Traders eye valuation.

Must Read