Important clarification: While markets are watching the US Supreme Court closely, any ruling referenced in this analysis remains potential, not scheduled. The Court does not pre-announce decisions. On a designated “decision day,” it may rule on any case currently before it. For background, see our related update here:

https://investinglive.com/news/no-opinion-today-on-tariffs-from-the-us-supreme-court-20260109/

Before we go into the expected scenarios and what you may consider trading, here's where you can watch it live when it starts!

Supreme Court & Trump Tariffs: Watch Live

Before it starts, here is a glimpse of the wisdom of the crowd and what the supreme court, in its view, will decide.

Event Risk Window: 8:30 AM ET (NFP) and 10:00 AM ET (Supreme Court opinion release)

Markets are heading into a rare convergence of macro, legal, and positioning risk, with traders navigating both the December US non-farm payrolls report and a potentially market-moving Supreme Court decision on Trump-era tariffs.

While payrolls normally dominate a Friday morning, attention today is clearly split. Many desks are already treating the jobs report as a secondary catalyst, with positioning light and volatility suppressed ahead of the 10:00 AM ET Supreme Court window.

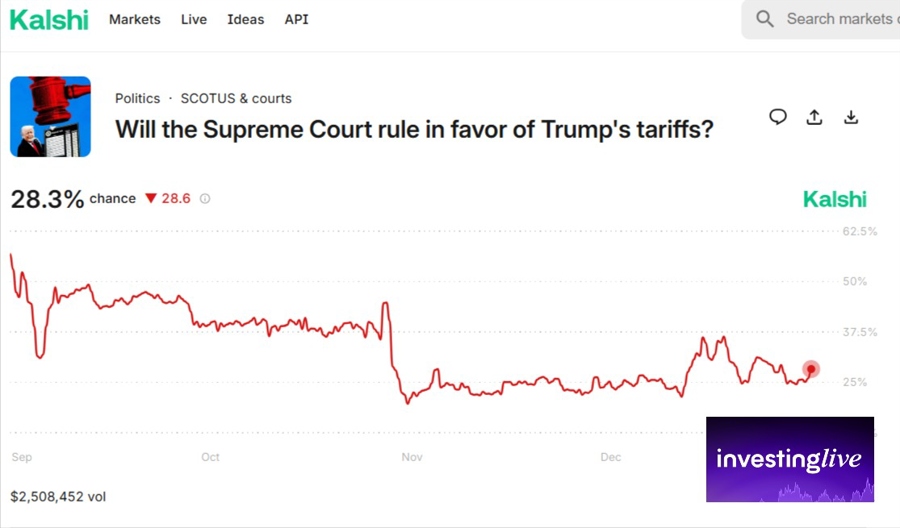

Will the court's (opinion) be supportive of Trump and tarrifs? What prediction markets are signaling

One of the clearest real-time sentiment gauges is the Polymarket contract asking whether the Supreme Court will rule in favor of Trump’s tariffs.

As of this morning:

Implied probability: ~25% that the Court upholds the tariffs

Market consensus: ~75% chance the tariffs are struck down or meaningfully limited

Trend: A sustained decline in odds since November, likely reflecting post-argument legal interpretation and positioning shifts

In short, the “smart money” in prediction markets is leaning heavily toward a negative ruling for the tariffs.

Why the Court's Rulling on Trump Tarrifs Matters for Today’s Trading

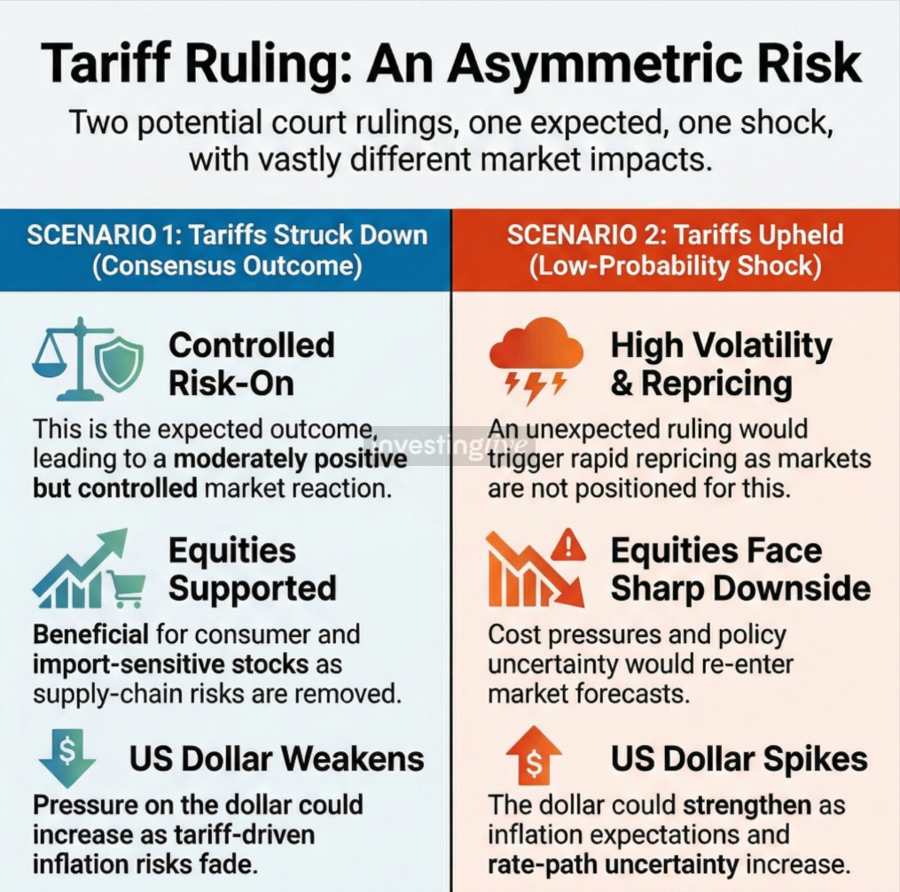

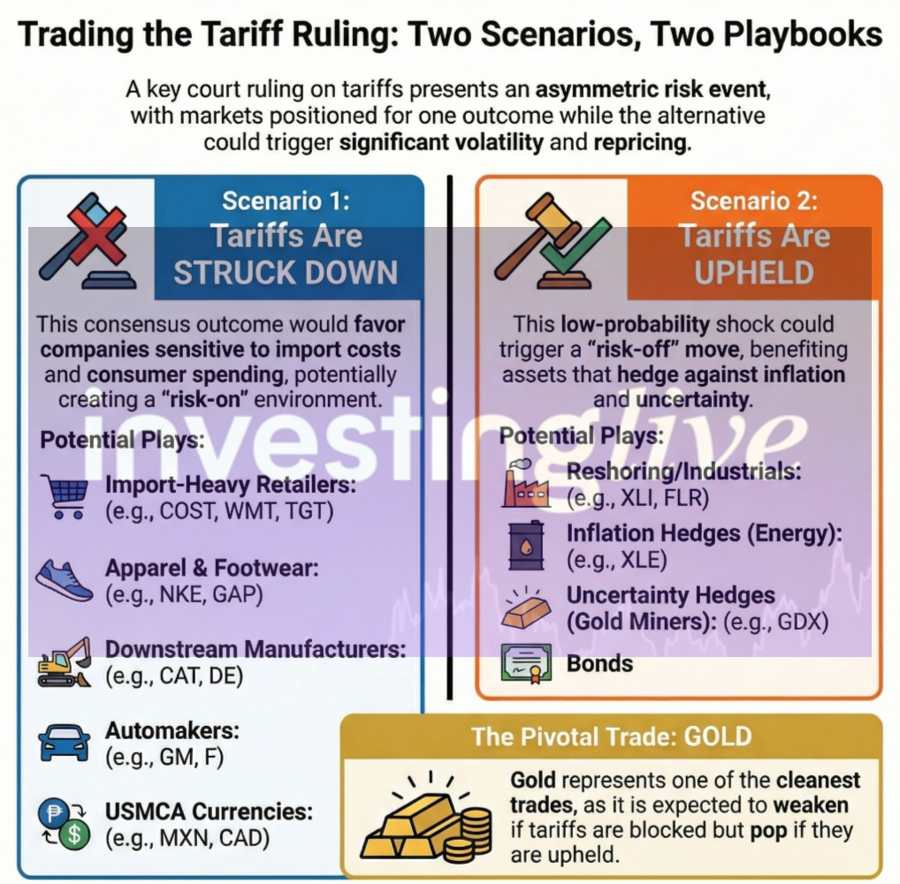

Because expectations are already skewed, the risk is asymmetric.

Scenario 1: Tariffs Are Struck Down (Consensus Outcome)

If the Court rules against the tariffs, markets are likely to interpret this as the removal of a long-standing inflationary and supply-chain risk.

Equities: Supportive, particularly for consumer discretionary and import-sensitive names

Broad sentiment: Risk-on, but likely controlled rather than explosive due to expectations already being priced

US Dollar: Potential downside pressure as tariff-driven inflation risk fades

In this scenario, the jobs report may act only as a secondary volatility layer, unless payrolls significantly surprise.

Scenario 2: Tariffs Are Upheld (Low-Probability Shock)

This is where volatility could accelerate.

Because markets are not positioned for this outcome, a ruling in favor of the tariffs could trigger rapid repricing:

Equities: Sharp downside as cost pressures and policy uncertainty re-enter forecasts

Sector rotation: Relative strength in domestic steel and materials, weakness elsewhere

Dollar: Potential spike as inflation expectations and rate-path uncertainty reprice higher

Why NFP Still Matters, but Less Than Usual

The December payrolls consensus sits near +60K jobs with a 4.5% unemployment rate, and some analysts see upside risk. However, even a surprise print may struggle to dominate flows if traders are already bracing for the legal headline.

As Adam Button noted earlier, markets appear “locked and loaded” for the Supreme Court release, with both US and Canadian jobs data potentially taking a back seat.

Remember, the above are just for you to consider as you do your own research. And watch the price action, be careful of end of the week volatilty as market makers can stop hunt both bulls and bears, in case you're trading this.

For deeper context on the legal timing and market implications, see our full breakdown here:

👉 InvestingLive.com analysis: The Supreme Court scheduled Friday as an opinion day: what’s the trade?

https://investinglive.com/news/the-supreme-court-scheduled-friday-as-an-opinion-day-whats-the-trade-20260106/

Bottom Line for Traders

Prediction markets suggest the tariffs are expected to fall. That means calm is priced in, shock is not.

From a decision-support perspective, today is less about prediction and more about reaction discipline. Watch the sequencing, respect volatility, and remember that when probabilities cluster this tightly, the minority outcome carries the most risk.

We will also be watching the Nasdaq order flow and what it can tell us.