- Prior 51.9

- Composite PMI 54.7

- Prior 52.1

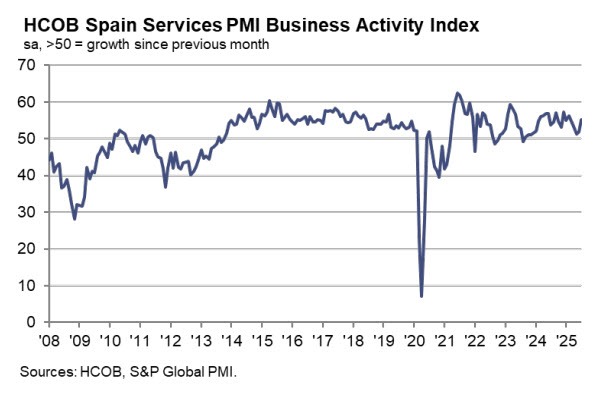

Once again, the Spanish economy is one of the bright spots in Europe with the services sector performing very well as summer kicks into gear. New business was seen rising at its fastest since February with growth primarily driven by the domestic economy. HCOB notes that:

“The latest HCOB PMI data is likely to be met with optimism in Spain’s private sector. Following the robust quarterly GDP growth of 0.7%, the July reading of the HCOB PMI Composite Output Index reinforces expectations that the current growth trajectory could persist in the coming quarters. As the second half of the year begins, the Spanish economy is exhibiting broad-based expansion, supported by both the services and manufacturing sectors.

“The service sector, in particular, is experiencing a notable upswing in activity and new business. Firms attributed the increase in domestic demand to targeted marketing efforts and improvements in service quality. While foreign demand has also picked up, it remains less dynamic than domestic demand; a divergence that reflects ongoing global trade policy uncertainties. In the short term, the new US–EU trade agreement may help reduce some of this uncertainty. In the short term, the new trade agreement between the US and the EU could have a stabilising effect, but in the medium term there remains a risk that the US government will once again resort to threatening higher tariffs as an economic policy lever.

“Rising activity levels have led to increased capacity utilisation in the services sector, as evidenced by a rise in backlogs of work. This already had a positive impact on employment dynamics in July. The robust level of business confidence suggests that hiring momentum is likely to continue in the coming months. In accommodation and food services, sectors traditionally facing structural labour shortages, migration inflows in recent years have played a key role in alleviating bottlenecks.

“Price pressures in the services sector remain elevated. Although the pace of input cost inflation has moderated over the course of the year, input price inflation continues to trend above pre-pandemic levels. Wage growth remains a primary cost driver, which is also reflected in continued increases in output prices.”