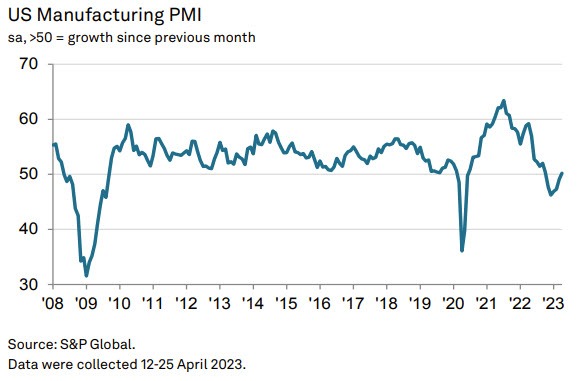

S&P Global US Manufacturing PMI

- Manufacturing PMI 50.2 versus 50.4 preliminary

- prior month 49.2

- signals expansion for the 1st time in 6 months

- Output and employment rise amid renewed upturn in new sales

- Rates of input cost and selling price inflation quicken

- US manufacturing sector shows slight improvement in April

- PMI at 50.2, first time above neutral mark (50.0) in six months

- New orders return to expansion territory, client demand remains muted

- Production increases at fastest pace since May 2022

- Domestic market drives demand, new export orders contract further

- Employment rate increases, fastest job creation since September 2022

- Suppliers raise prices despite improved supply chains and vendor performance

- Cost burdens rise sharply, selling prices increase at an accelerated rate

- Output levels at goods producers rise modestly, fastest growth in close to a year

- Input costs and output charges increase at steeper rates in April

- Employment expands at the fastest pace in seven months

- Backlogs of work decline for the seventh consecutive month

- Manufacturers' output expectations show optimism, in line with long-run average

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, said:

“US manufacturing output has regained some encouraging momentum at the start of the second quarter, having stabilised in March after four months of decline. “While the upturn is in part linked to greatly improved supply chains, helping reduce backlogs of orders, April also saw a welcome upturn in new order inflows for the first time since last September. “Although only modest, the rise in new orders hints at a tentative revival of demand, notably from consumers but there are also signs that fewer customers are deliberately winding down their inventory levels.

The brightening demand picture was accompanied by a lifting of business confidence about the outlook and increased hiring. The downside was a reigniting of inflationary pressures, with a stronger order book encouraging more firms to pass through higher costs to customers.”

The USD has moved marginally higher but overall the USD remains weaker today.

For the full report CLICK HERE

The ISM Manufacturing PMI for April will be released at 10 AM ET along with construction spending. ISM is expected to come in at 46.8 versus 46.3 last month with prices paid coming in at 49.0 versus 49.2. The employment component came in at 46.9 last month with new orders at 44.3.

Construction spending for March is expected at 0.1% versus -0.1% last month