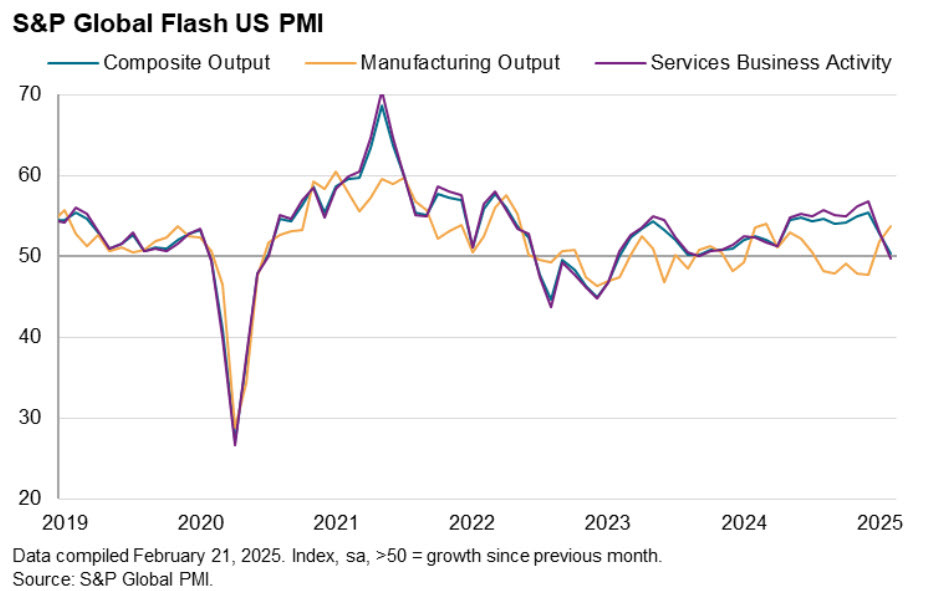

- Prior was 52.9

- Manufacturing 51.6 vs 51.5 expected

- Prior manufacturing was 51.2

- Composite PMI 50.4 vs 52.7 prior

- "New order growth also weakened sharply and business expectations for the year ahead slumped amid growing concerns and uncertainty related to federal government policies" the report said

- Input cost pressures "spike higher"

- Services output costs fell near a 5-year low

The January services reading was the lowest since April but this is much worse and the lowest since early 2023.

The upbeat mood seen among US businesses at the start of the year has evaporated, replaced with a darkening picture of heightened uncertainty, stalling business activity and rising prices.

"Optimism about the year ahead has slumped from the near-three-year highs seen at the turn of the year to one of the gloomiest since the pandemic. Companies report widespread concerns about the impact of federal government policies, ranging from spending cuts to tariffs and geopolitical developments. Sales are reportedly being hit by the uncertainty caused by the changing political landscape, and prices are rising amid tariff-related price hikes from suppliers.

Whereas the survey was indicating robust economic growth in excess of 2% late last year, the February survey signals a faltering of annualised GDP growth to just 0.6%.

While overall inflationary pressures remained muted, this reflected a squeezing of margins in the services sector as companies sought to absorb cost increases in order to offer competitive prices amid weakened demand. A concern is the sharp, tariff-related, jump in manufacturing input prices, which will likely either put further upward pressure on inflation in the coming months or further squeeze profit margins among US companies."

There have been a series of worsening survey-based measures, including on consumers. It's tough to tell if that's political noise or angst but it's been sustained for a worrying amount of time. The US dollar is lower on the headlines, with USD/JPY down about 40 pips quickly.