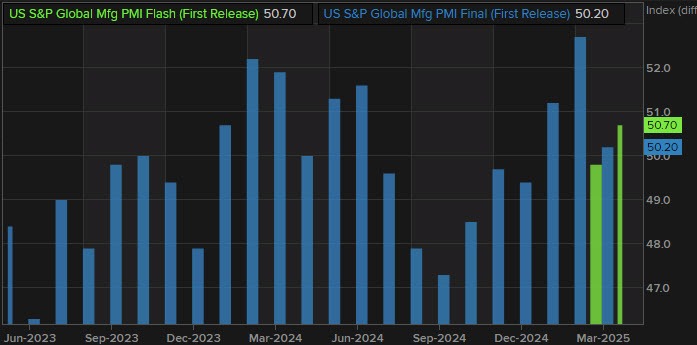

- Prior month 50.2

- Manufacturing PMI 50.7 versus 50.2 last month

- Services PMI flash for April 51.4 versus 52.5 estimate. Prior month 54.4

- Composite index 51.2 versus 53.5 last month.

For the full report CLICK HERE.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, highlights growing economic challenges in the latest April flash PMI report. Here are the key takeaways from his comments:

Business activity growth slowed sharply in early Q2, with optimism about the outlook slumping.

Output rose at the slowest pace since December 2023, suggesting the US economy is expanding at just a 1.0% annualized rate.

Manufacturing stagnated due to offsetting effects of tariffs, economic uncertainty, supply chain issues, and declining exports.

Services growth also slowed, particularly from weaker export demand like travel and tourism.

Business confidence fell significantly across both manufacturing and services, driven by concerns over recent government policies.

Tariffs are the main driver of rising prices, but labor costs are also pushing up company pricing.

Selling prices rose at the fastest pace in over a year, with manufacturing prices increasing at the steepest rate in nearly 2.5 years.

These price pressures may lead to higher consumer inflation, making it harder for the Fed to cut interest rates despite signs of economic slowdown.