The flash S&P Global manufacturing and services PMI data for December is out and shows weakness:

- Prior month manufacturing 52.2

- Manufacturing flash PMI 51.8 versus 52.0 estimate

- Services PMI flash 52.9 versus 54.0 estimate. Prior month 54.1..

- Composite index 53.0 versus 54.2 last month

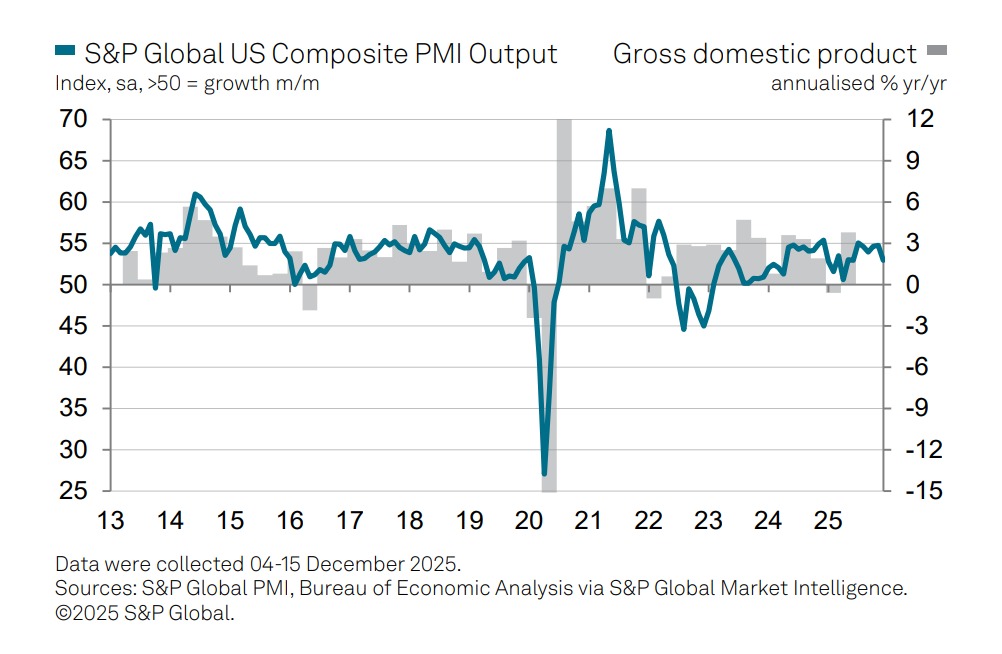

Below is a chart of the composite PMI compared to GDP growth.

The data is all in expansion mode above the 50.0 level, but all are less than expected as well.

Details on the key components from S&P Global shows:

Employment

Employment growth softened in December, slipping to a marginal pace and the weakest since September. Manufacturing jobs improved modestly, posting the strongest gain in four months, but service-sector employment nearly stalled, recording the smallest net payroll increase since April. Firms cited cost pressures, weak demand, and economic uncertainty as constraints on hiring, though labor shortages persisted in some areas.

Future sentiment

Business expectations for the year ahead remained positive overall, but confidence deteriorated slightly and stayed below the long-run average. Companies pointed to price increases, uncertainty, and softer customer spending, often linked to tariffs and government policy concerns, as drags on sentiment. These headwinds were partially offset by hopes for lower interest rates, fiscal support, and planned investment in new products, marketing, and capacity.

Prices and inflation

Input cost inflation accelerated sharply, reaching its fastest pace since November 2022. While manufacturers saw slightly slower cost growth, inflation remained historically elevated, and services input costs surged to the steepest rate in more than three years. Tariffs and rising labor costs were the primary drivers. Higher costs fed through to selling prices, with overall price inflation rising to its highest level since July, among the strongest since the 2022 inflation surge. Manufacturers struggled to pass on costs due to competition, while service-sector price increases were the strongest since August 2022.

Inventories and supply chains

With manufacturing output holding up but new orders declining, backlogs fell, prompting factories to cut input purchases for the first time since April. Inventories of unsold goods continued to build, though at a slower pace than the record accumulation seen in October and November. Despite reduced buying, supplier delivery times lengthened significantly, among the worst delays of the past three years, partly reflecting weaker import supply conditions.

Manufacturing PMI

The US Manufacturing PMI eased to 51.8 from 52.2, signaling a fifth consecutive month of expansion, but at the weakest pace of that run. Production growth slowed to a three-month low, as new orders fell for the first time since December 2024. Supporting the index were faster employment growth and longer supplier delivery times, which helped offset softer demand and slower inventory accumulation.

Bottom line: the report points to slowing but still expanding activity, cooling labor momentum, and renewed inflation pressures, especially in services—keeping the Fed firmly data-dependent as growth resilience and price risks remain in tension.

Chris Williamson, Chief Business Economist at S&P Global Market Intelligence:

- The flash PMI data for December suggest that the recent economic growth spurt is losing momentum. Although the survey data point to annualized GDP expansion of about 2.5% over the fourth quarter, growth has now slowed for two months. With new sales growth waning especially sharply in the lead up to the holiday season, economic activity may soften further as we head into 2026.

- The signs of weakness are also broad-based, with a nearstalling of inflows of work into the vast services economy accompanied by the first fall in factory orders for a year. While manufacturers continue to report higher output, lower sales point to unsustainable production levels which will need to be lowered unless demand revives in the new year. Service providers reported one of the slowest months for sales growth since 2023.

- Firms have also lost some confidence in the outlook and have restricted their hiring in December in accordance with the more challenging business environment. A key concern is rising costs, with inflation jumping sharply to its highest since November 2022, which fed through to one of the steepest increases in selling charges for the past three years. Higher prices are again being widely blamed on tariffs, with an initial impact on manufacturing now increasingly spilling over to services to broaden the affordability problem.

The EURUSD is extending to new highs on the day and extended above a swing area high at 1.1788. The current price is trading at 1.1793. See video for key levels in EURUSD, USDJPY and GBPUSD.

The USDCAD isextending lower and toward a key target swing area between 1.3720 and 1.3726 . The low price of just reached 1.3731.