S&P 500 Trader Update. Grinding Higher, But Momentum Is Selective

The S&P 500 continues to trade constructively, but recent price action suggests the market is grinding rather than accelerating. Earlier buying pressure has cooled, and order flow now reflects more two-sided trade near recent highs. This is typical behavior when markets approach important reference levels and liquidity pockets.

From a short-term perspective, upside attempts are still present, but follow-through has become more selective. Volume remains healthy, yet price progress has slowed, signaling that buyers are active but increasingly meeting supply. This does not imply a bearish reversal, but it does raise the importance of patience and confirmation.

Why NASDAQ Matters Here

At the same time, NASDAQ futures are trading close to their all-time high at 26,399, with price currently near 26,237 at the time of this analysis. Markets often gravitate toward such widely watched levels to test liquidity sitting just above and below them. A continued grind higher in NASDAQ to probe that area would be consistent with the broader theme of slow, methodical upside rather than impulsive breakout behavior.

If NASDAQ does push into that all-time-high zone, it would support the idea that the S&P 500 can continue to edge higher as well, even if the move remains uneven.

What Traders Should Watch

Upside: Continued higher highs with steady participation would keep the bullish structure intact, but acceleration is needed to improve confidence.

Pullbacks: Shallow pullbacks that stabilize quickly would suggest consolidation rather than distribution.

Risk signals: Increased selling pressure without quick recovery would indicate that the grind higher is losing sponsorship.

Markets do not always move higher through strong rallies. Often, especially near key highs, they advance through grinding price action, where liquidity is absorbed gradually. This environment tends to punish late entries and rewards traders who wait for clearer confirmation or better locations.

orderFlow Intel Snapshot – Why the Market Is Grinding, Not Breaking

From an orderFlow Intel perspective, the S&P 500 continues to show constructive but increasingly selective behavior. Earlier in the session, buying pressure was clearly dominant, with multiple higher-timeframe bars printing positive delta on expanding volume, confirming initiative buyers were still willing to transact at higher prices. However, as price moved closer to recent highs, that dynamic shifted. Volume remained elevated, but delta efficiency deteriorated, meaning more contracts were traded for less net price progress. This transition from expansion to two-sided trade is a common signal that the market is entering a late-phase or rotational environment, rather than an early-stage breakout.

More recently, order flow data showed a notable burst of selling pressure, with one higher-volume bar printing a meaningfully negative delta, followed by only modest positive responses. Importantly, buyers did not immediately regain control with the same intensity seen earlier in the move. That does not point to a bearish reversal, but it does indicate that upside continuation now requires additional proof, rather than being assumed. In practical terms, the market is still supported, but upside progress has become harder and more conditional.

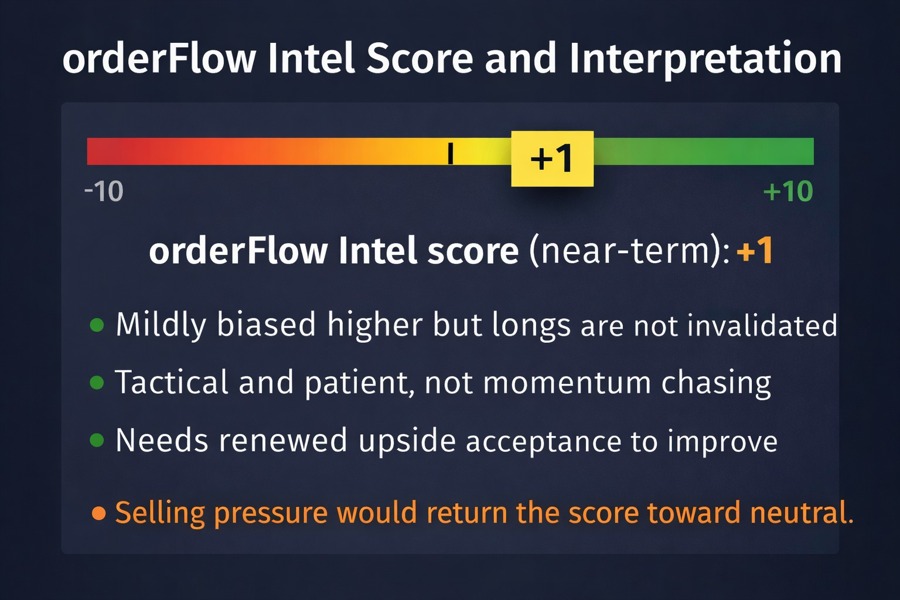

orderFlow Intel Score and Interpretation

orderFlow Intel score (near-term): +1

This score reflects a market that is still biased higher, but only mildly so. A score in this range signals that longs are not invalidated, yet the environment favors tactical positioning and patience rather than aggressive momentum chasing. The score is capped by signs of buying fatigue and rising two-way trade near key reference levels. To move the score higher, the market would need to show renewed upside acceptance, with stronger participation and cleaner follow-through. Conversely, a further increase in selling pressure without quick recovery would pull the score back toward neutral.

Why This Matters for Traders

Order flow is particularly valuable in environments like this, where price alone can be misleading. A grinding market can continue higher, but it often does so while absorbing liquidity and punishing late entries. The current orderFlow Intel read suggests that risk is asymmetric for traders who chase strength, while better opportunities are likely to emerge either after clearer acceptance higher or following a controlled pullback that resets participation.

Earnings Crosscurrents Add to the Selective Tape

Individual stock reactions to earnings continue to underline how selective this market has become. META shares surged +7.7% following its latest earnings release, while IBM jumped +7.4%, highlighting pockets of strong investor conviction. LRCX also traded sharply higher, up +6.2% in extended hours after beating expectations. TSLA gained a more modest +2.4% after its Q4 results, reflecting a more balanced reception.

On the other side of the ledger, not all earnings were rewarded. MSFT shares tumbled −6.6%, marking their worst post-earnings reaction in more than three years, while NOW fell −5.6% in extended trading despite reporting strong results. These sharply diverging outcomes reinforce a key theme for index traders: headline index strength can mask significant dispersion underneath, with winners and losers reacting very differently to similar macro conditions.

This kind of dispersion often coincides with late-cycle or high-level index trading, where capital rotates rapidly rather than moving uniformly across the market.

Broader Market Context and What’s Still Ahead

Beyond earnings, markets are navigating a dense and evolving backdrop. Traders are tracking the main events shaping today’s session, while also keeping an eye on what remains ahead as January wraps up (plenty still to come!), including macro releases and policy developments that could influence near-term risk appetite. Political headlines are also back in focus, with reports that Trump and Schumer may be approaching a possible deal to avert a shutdown, a factor that could temporarily ease uncertainty.

Globally, risk sentiment received an additional boost after China property shares jumped on reports of easing the “three red lines” rules, adding to the broader narrative of selective risk-on behavior rather than broad-based enthusiasm.

For another walkthrough of today’s market setup and key themes, traders can also reference this Nasdaq video update covering the evolving landscape and major catalysts.