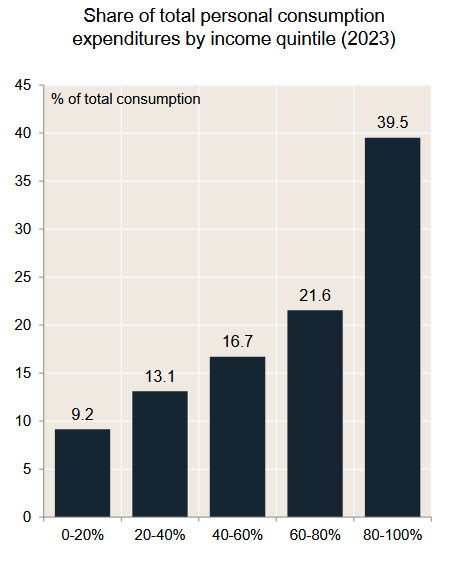

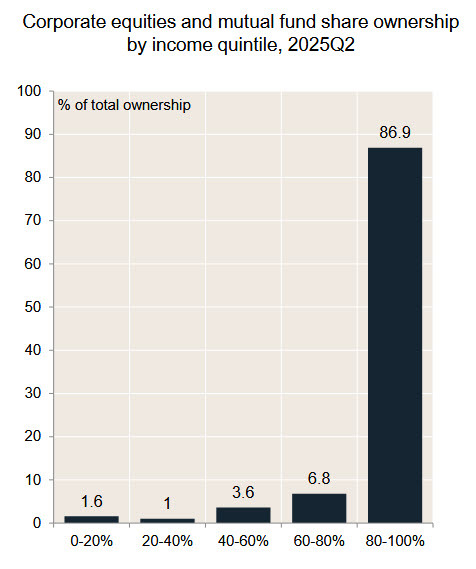

We don't have economic data at the moment due to the US government shutdown but some other themes are emerging from the scattered reports we have and a big one is the 'K-shaped' economy. This is a theme that's been unfolding in the background for years and comes to prominence from time to time.

At the moment, it's particularly strong because the older/richer cohorts have benefited from house price inflation and equities while the non-home owning class doesn't own stocks and is paying higher rents. The wage hikes from the pandemic are now also in the rearview mirror.

Here is what Fed Chairman Jerome Powell said:

“On the K-shaped economy thing, I would say the same thing, or similar thing. We are — if you listen to the earnings calls or the reports of, you know, big public consumer-facing companies, many, many of them are saying there is a bifurcated economy there, and that consumers at the lower end are struggling and buying less and shifting to lower-cost products. But at the top people are spending, at the higher income and wealth — so, much, much anecdotal data on that. So, we think there is something there.”

Here are some telling (and differing quotes) from various executives this week:

Scott Boatwright – CEO, Chipotle (CMG)

“Earlier this year, as consumer sentiment declined sharply, we saw a broad-based pullback in frequency across all income cohorts… the gap has widened, with low- to middle-income guests further reducing frequency... We’re not losing them to competition… We’re losing them to grocery and food at home.”

Ryan McInerney – CEO, Visa (V)

“We are assuming the macroeconomic environment stays generally where it is today and consumer spending remains resilient.”

“Growth across consumer spend bands remained relatively consistent…with the highest spend band continuing to grow the fastest.”

Visa expects a "strong quarter" in Q4 with no material slowdown in holiday sales.

Caterpillar executive Joseph Creed:

“North America increased 11%… due to growth in both residential and nonresidential construction... We saw a decline in Asia Pacific… resulting from softness in a few key subregions... In EAME, we expect growth for the year… and improving economic conditions in Europe.”

Caterpillar executive Andrew R. Bonfield

“We remain optimistic about our underlying business… supported by healthy demand signals, including a robust backlog and growth in sales to users.”

Shane O’Kelly – President & CEO of Advance Auto Parts:

“Tariff-related price increases have accelerated in the auto aftermarket… we saw some variability in performance as prices moved higher… there is potential for temporary volatility in sales trends as consumers manage household budgets in an inflationary backdrop.”

“We’re keeping an eye on the low- to mid-income consumer… data points suggest they may be depressing their spend… subprime auto, consumer sentiment, discretionary spend, credit cards — and that impacts how they spend.”

Ryan Grimsland – EVP & CFO of Advance Auto Parts:

“Q4 has started off soft… the DIY channel is seeing pressure with more week-to-week variability in transactions, driven primarily by adjustments in consumer purchasing habits in response to rising prices.”

“We’re seeing the consumer impacted across retail… still trying to parse what’s price elasticity versus other macro factors (e.g., government shutdown).”

Bill McDermott (Chairman & CEO, ServiceNow)

“AI is going to reorient the global economy" but also "I was with 150 CEOs… they were telling me their proof of concepts, these toy sidecars, are getting crushed. They don’t want to do them anymore… they have so much complexity in their business processes that they’re having trouble making AI work.”

I shared these two telling charts earlier in the week.