For most of 2024 and into 2025, the default playbook for investors and even many family offices has been simple: stay long the S&P 500. It worked, and it worked without much need for active management. Add in a dash of gold for safety, and you had the consensus strategy. But markets don’t reward everyone who follows the crowd forever. Beyond the familiar equity indexes and the classic safe havens lies a set of metals often overlooked by mainstream portfolios – and that’s where platinum and, to a quieter degree, palladium are starting to turn heads.

Why Platinum and Palladium Matter for Investors and Industry

Platinum and palladium aren’t just shiny metals – they sit at the heart of global industry. From catalytic converters and electronics to jewelry, medical devices, and clean energy tech, these metals quietly shape the world around us.

Platinum: Known for cutting auto emissions, powering hydrogen fuel cells, and delivering durability in jewelry.

Palladium: The go-to twin when automakers or manufacturers need a substitute – it’s chemically similar, and when platinum runs hot, palladium demand often spikes.

Both are scarce, mined mostly in South Africa and Russia, and both see wild swings when supply chains tighten or when industries switch between them.

The Quick Commodities Performance Snapshot

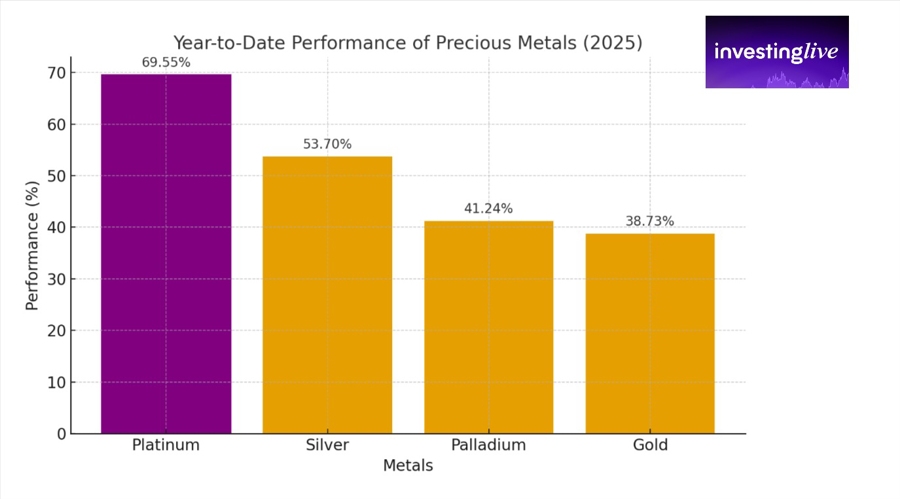

Here’s the scorecard for 2025 so far:

Platinum: +69.55%

Silver: +53.70%

Palladium: +41.24%

Gold: +38.73%

Platinum is the undisputed leader. Silver has impressed, palladium is still quietly climbing, and gold – while strong – looks like the conservative cousin compared to these moves.

The Platinum Technical Story – A 17-Year Breakout

Platinum just delivered one of the biggest technical signals in commodities: a breakout from a 17-year bull flag.

The setup: Three clean touch points on the upper band confirmed the pattern.

The breakout: Price surged through with momentum, validating the structure.

The target: The 2008 high at $2,308.8, still +41% above current prices.

This doesn’t mean platinum rockets straight there – no chart pattern plays out that cleanly. Expect pullbacks, retests, and stair-step progress. But the breakout itself is real, and the long-term bias is firmly higher.

Where Smart Money Looks to Buy the Dip (only in the short term)

Key areas on the chart:

$1,605 – above recent Value Area High

$1,593 – just above VWAP, just under the round $1,600

$1,577–$1,579 – a liquidity pocket worth watching

Deeper zones if tested: $1,550 and $1,533

How pros approach it (because these short term levels might not be the end of a possible dip):

They scale in, splitting allocations across levels. One-third here, one-third there, leaving ammunition for deeper zones.

They take partial profits on rebounds and move stops to entry once trades are working.

This staged, risk-controlled style mirrors the tradeCompass framework at investingLive.

Palladium – The Quiet Contender

Here’s the twist: while platinum steals the headlines, palladium is quietly lining up as the sleeper trade.

Industrial users: Automakers can and do switch between platinum and palladium in catalysts.

Investors: Those who see platinum as extended may rotate into palladium for catch-up upside.

Underrated: It hasn’t had the same spotlight, which can mean better entry points for those paying attention.

The platinum-to-palladium price ratio is a great dashboard for spotting when substitution flows are likely to matter.

How to Invest in Platinum: From Zero to First Trade

New to platinum or palladium? Here are your on-ramps:

Platinum ETFs & Trusts

Platinum: PPLT, PLTM

Palladium: PALL

Baskets: GLTR, SPPP

Easy, liquid, no storage hassles.

Physical Bullion

Coins and bars through dealers.

Tactile, no fund counterparty risk, but bigger spreads and storage costs.

Platinum Futures (CME)

For advanced traders.

Efficient, leveraged, but risky if you don’t know margin calls inside out.

Platinum Mining Equities

Stocks of producers with PGM exposure.

Equity upside, but with company-specific risks attached.

Thematic Funds in Platinum

Hydrogen, fuel cell, and clean-energy ETFs.

Indirect exposure, tied to sector cycles.

Beginner tip: Start with ETFs, build in small size, and add on pullbacks. Don’t chase green candles.

Risks You Can’t Ignore When Investing in Platinum

EV adoption reducing demand for combustion catalysts.

Substitution risk (platinum ↔ palladium).

Supply swings in South Africa/Russia.

Liquidity crunches, wider spreads, futures leverage.

Taxes and regulations on bullion in your country.

Swing Traders’ Playbook for Platinum Futures

Treat $1,605 / $1,593 / $1,577–$1,579 as buy zones.

Scale in with thirds.

Respect invalidation: below $1,550, re-evaluate.

Use two to three partial profit targets and trail the runner. After TP2, move stop to entry.

Don’t forget palladium – sometimes the less obvious trade is the better one. My target for Paladium futures price forecast (within a year), for the patient investor, is $1500, so there is still a big upside. But remember, I might be wrong and you have to do your own research and always invest or trade at your own risk only.

So, Platinum just staged one of the most significant breakouts in the commodity space, backed by real demand and a 17-year chart pattern. The upside case is there, but so are the risks. Long-term investors can scale into dips, while swing traders can lean on well-defined zones. And don’t ignore palladium – the quiet twin that often benefits when platinum gets too much love.

This is an educational overview, not financial advice. Always trade and invest at your own risk. For live levels and updated trade ideas, follow along at investingLive.com, formerly ForexLive.com