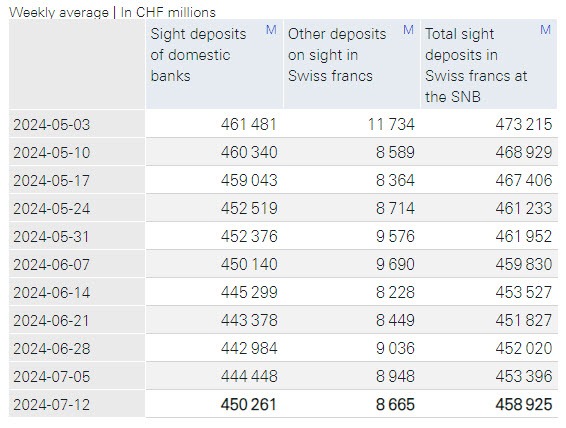

- Domestic sight deposits CHF 450.3 bn vs CHF 444.4 bn prior

After weeks of decline, Swiss sight deposits look to be stabilising a bit. That might indicate the SNB is staying more on the sidelines in the last two to three weeks. Here's the trend:

After weeks of decline, Swiss sight deposits look to be stabilising a bit. That might indicate the SNB is staying more on the sidelines in the last two to three weeks. Here's the trend:

Most Popular

Bitcoin holds $96.2K, up 6% weekly, eyeing $100K. Ether near $3.3K. Mixed macro, but crypto market cap hits $3.25T.

Nvidia's H200 chip sales to China face hurdles; US policy shifts with surcharges, impacting AI hardware valuations.

UK pubs get rates relief as borrowing costs drop £3.7bn. Hotels & restaurants seek similar support amid rising tax bills.

Crypto bill markup delayed again, extending regulatory uncertainty. Coinbase withdraws support. 60% chance of passage.

Critical minerals trade talks begin; gold/silver retreat from highs. No tariffs for now, focus on overseas supply.

Arizet launches gamified prop trading platform, targeting 7% success rate traders. Not the cheapest, but a revenue source.

US slaps 25% tariff on high-end AI chips, hitting Nvidia & AMD sales in China. Traders eye impact on valuations.

Must Read