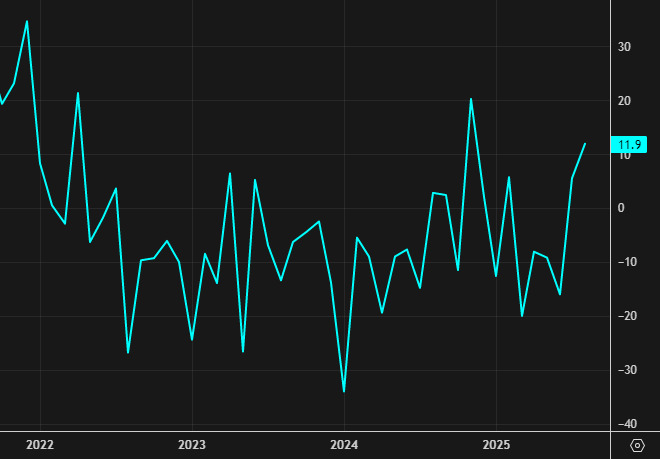

- Prior reading was +11.9

- New orders: -19.6 vs +15.4 prior

- Shipments: — vs +12.2 prior

- Unfilled orders: -6.9 vs -5.5 prior

- Delivery times: 0.0 vs +17.4 prior

- Inventories: -4.9 vs -6.4 prior

- Prices paid: +46.1 vs +54.1 prior

- Prices received: +21.6 vs +22.9 prior

- Employment: -1.2 vs +4.4 prior

- Average employee workweek: -5.1 vs +0.2 prior

Six-month ahead expectations:

- General business conditions: +14.8 vs +16.0 prior

- New orders: +16.6 vs +16.3 prior

- Capital expenditures: -3.9 vs -0.9 prior

This is a poor manufacturing reading and takes it right back to the post-Liberation Day range. I wouldn't say it throws up some kind of major red flag but companies are clearly having trouble navigating the playing field.

Empire Fed is a monthly survey from the New York Fed that takes the pulse of manufacturing in the region. It’s the first read on factory activity each month and often sets the tone for sentiment in the sector. It’s not the biggest market mover on its own, but sharp swings can move the dollar and bonds, especially if they hint at shifting momentum in the US economy.

There has been some modest slackening in the US dollar following the release and that's left it near session lows against the euro, yen, pound and commodity currencies.