Good morning all,

It's all feeling rather rudderless out there today, Asian equity markets are closing will millpond levels of flatness, following yesterday's impressive edition of BTFD stateside.

Newsquawk's top takes:

:: An indecisive tone was seen across APAC markets overnight

:: US equity futures traded flat with a downside bias

:: In FX, DXY traded on either side of 96.500, USD/JPY briefly dipped under 114.00 and AUD/JPY drifted lower

:: Oxford and AstraZeneca are working on an Omicron-targeted version of their vaccine

:: UK PM Johnson does not think there is enough evidence to justify any tougher restrictions before Christmas

:: Looking ahead, highlights include UK GDP, US GDP, Consumer Confidence, Existing Home Sales

This morning, at 07:00GMT we get UK GDP, which although traditionally classed as Tier-1 data, given its backwards-looking makeup, and markets only have eyes for what economic impacts Omicron may bring going forward, don't be surprised if market participants are happy to ignore the data. I'll be shocked if we see any serious moves in GBP on the release.

Nomura, on UK GDP and current account data:

"We don’t expect any change in headline quarterly growth for Q3 with the latest monthly data confirming that GDP expanded 1.3% q-o-q.

Look out for data on excess savings, income and the breakdown of consumer spending (in Q2 private consumption was almost 6% below the peak – goods 7% higher, services 14.5% lower).

A near-£10bn worsening of the goods trade deficit in Q3 (weaker exports, higher imports), only modestly offset by a £2bn improvement in services, suggests a £15bn current account deficit during the quarter (Q2 was £8.6bn)."

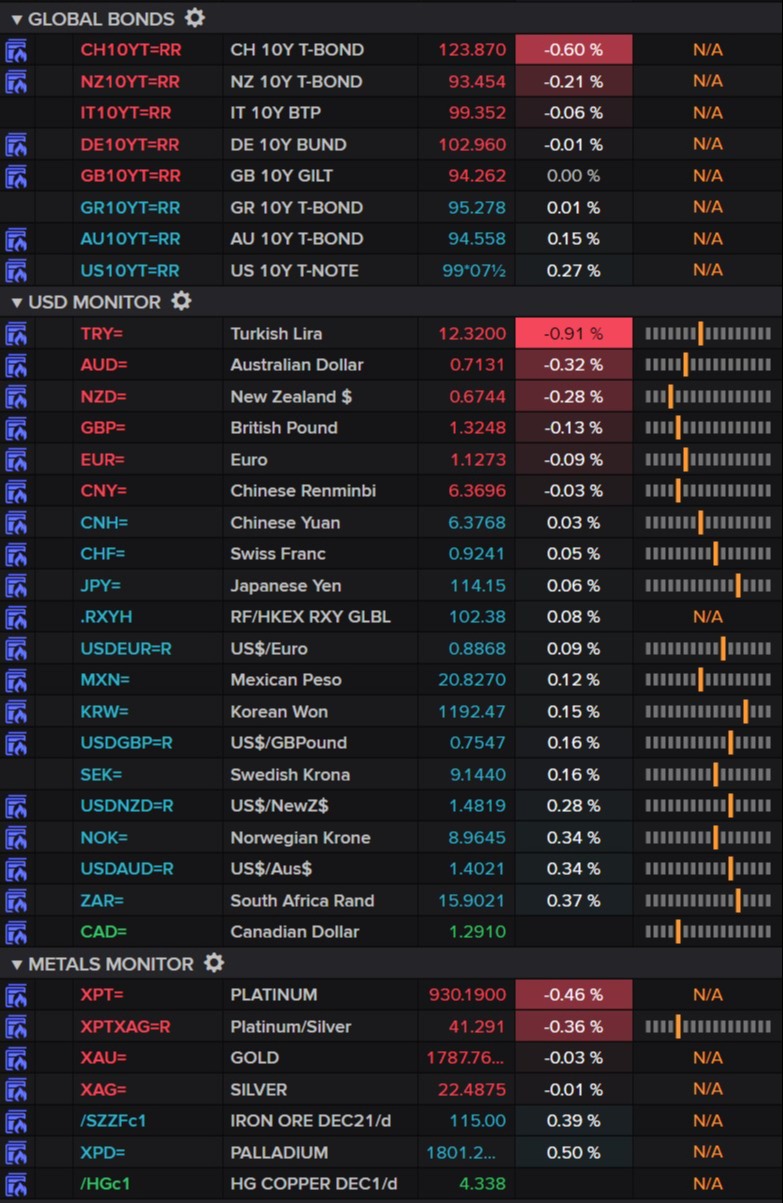

A quick snapshot of bond, FX and metals...

Remember, these are holiday markets, liquidity is reduced and the chances of chop are high.

Don't try to be a hero.

Keep it tight!