- Still like equities , but we have come a long way pretty quickly

- Can evolve the portfolio and have a bit less equities at these multiples

- You can get a lot of yield without going out on the yield curve

- Thinks the Fed cuts rates at September meeting

- Personally I think the fed funds rate is priced wrong

- I would do 50 basis point cut sooner and I would have cut in July

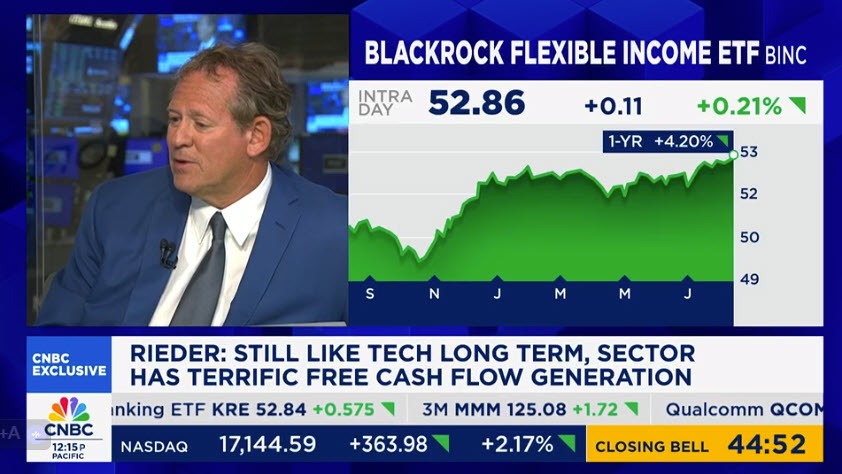

- I still like tech long-term, sector has terrific free cash flow generation

- It's worth taking some chips off the table after this big rebound.

- We're moving in the right direction on inflation

Looking at the US stock market

- The S&P index is up 78.75 points or 1.47% at 5423.06. Its high price reached 5430.75.

- The NASDAQ index is up 356.42.12 percent at 17135. Its high price reached 17174

Looking at the S&P sectors, the gains are led by information technology while the laggard and only negative sector is the energy sector.

- Information Technology (SSINFT): +2.60%

- Consumer Discretionary (SSCOND): +2.15%

- Health Care (SSHITH): +1.13%

- Utilities (SSUTIL): +1.09%

- Industrials (SSINDU): +0.85%

- Materials (SSMATR): +1.00%

- Consumer Staples (SSCONS): +0.26%

- Real Estate (SSREAS): +0.71%

- Telecommunication Services (SSTELS): +1.35%

- Financials (SPF): +0.62%

- Energy (SPN): -0.94%