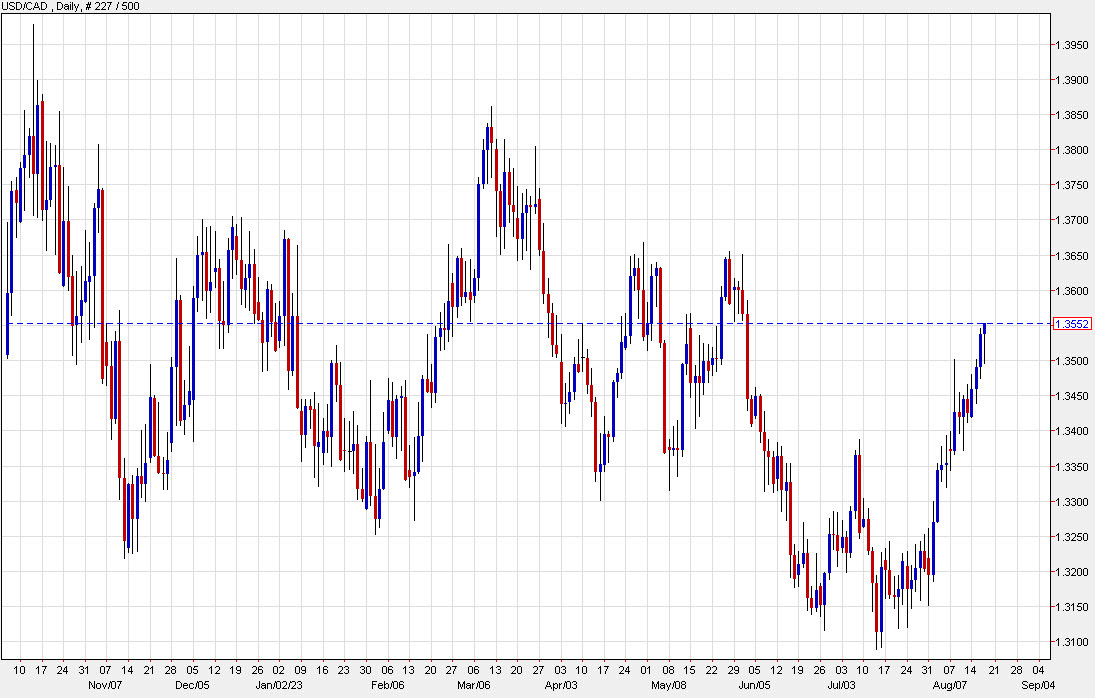

RBC provides insights on the future trajectory of USD/CAD, which has already hit their end-Q3 forecast of 1.35. Here are the main takeaways:

Short-Term Uncertainty: USD/CAD's trajectory seems uncertain in the near term, likely to be influenced by developments around the USD. The bank believes the currency pair will see a range-bound movement in the coming days and weeks.

Year-End Forecast: RBC maintains its year-end target for USD/CAD at 1.38. This forecast hinges on a mild recovery in the USD towards the end of the year.

Factors Influencing Movement: RBC is currently monitoring for signs of either a US or global economic slowdown. The distinction is crucial because a slowdown in the US would put downward pressure on USD/CAD, while a global downturn would likely support the currency pair.

In summary, RBC's view on USD/CAD is cautious. While they have retained their short-term and year-end forecasts, they emphasize the role of the broader USD trend and global economic dynamics in shaping the pair's future direction

I wrote about my target for USD/CAD here.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.