The dollar is staying on the softer side as we look towards European trading today, with last Friday's post-NFP relief only proving to be a fleeting moment for the greenback. The technicals are still poor and I will talk about them more during the session but I've already outlined some cases last week here.

Broader market sentiment is more tentative with S&P 500 futures seen down 4 points, or 0.1%, while 10-year Treasury yields are up by a fair bit to 3.53%. The bond market is still a key spot to watch as pointed out here earlier but there isn't much for traders to work with as we get into the new week.

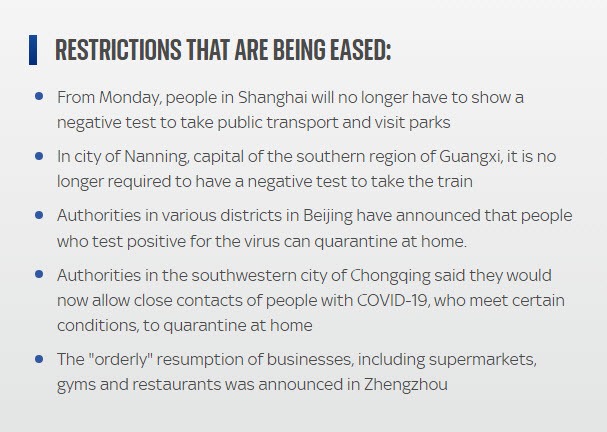

The weekend developments saw OPEC+ rolling over production quotas, ECB policymaker Villeroy endorsing a 50 bps rate hike, and China continuing to loosen Covid restrictions. Here's a quick snapshot on some of the curbs that were relaxed:

Looking ahead to Europe today, there will be some data points to move things along but I would expect trading sentiment to continue to focus on the risk mood and the technicals as traders look to get settled in.

0815 GMT - Spain November services PMI

0845 GMT - Italy November services, composite PMI

0850 GMT - France November final services, composite PMI

0855 GMT - Germany November final services, composite PMI

0900 GMT - Eurozone November final services, composite PMI

0900 GMT - SNB total sight deposits w.e. 2 December

0930 GMT - UK November final services, composite PMI

0930 GMT - Eurozone December Sentix investor confidence

1000 GMT - Eurozone October retail sales

That's all for the session ahead. I wish you all the best of days to come and good luck with your trading! Stay safe out there.

9 - With his two goals against Poland, Kylian Mbappé becomes the first player to score 9 goals in the World Cup before his 24th birthday.