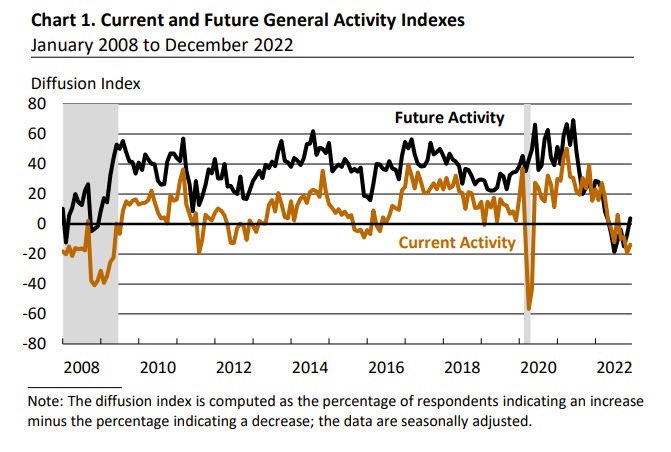

Philadelphia Fed current and future activity index

- Philadelphia Fed business index versus -10.0 estimate. Last month -19.4

- employment -1.8 versus 7.1 last month

- prices paid 26.4 versus 35.3 last month

- Prices received 24.3 versus vs 34.6 last month

- new orders -25.8 versus -16.2 last month

- shipments -6.2 versus 7.0 last month

- unfilled orders -14.7 versus -22.9 last month

- delivery times -11.9 versus -8.8 last month

- inventories -2.7 versus -6.5 last month

- average employee work week -8.9 versus 1.4 last month

six-month forward measures

- business activity 3.8 versus -7.1 last month

- capital expenditures 18.0 versus 6.4 last month

- new orders 13.6 versus -4.8 last month

- employment 18.4 versus 11.1 last month

- shipments 22.5 versus 10.2 last month

- prices paid 39.22 versus 18.5 last month

- prices received 32.7 verse 15.7 last month

- average work week -0.7 versus -12.1 last month

Inflation readings are lower currently, but six-month forward price expectations moved higher. Growth is slower with new orders falling to -25.8 and shipments also going negative at -6.2.

From the Philadelphia Fed:

- The survey’s broad indicators for current activity were all negative. The firms on balance also reported a decline in employment. The future indicators improved,suggesting that the firms expect overall growth over the next six months.

- The index is activity index of -13.8 was the fourth consecutive negative reading in sixth negative reading in the past seven months

- the employment index dipped into negative territory for the first time since June 2020 with 19% of firms reporting declines in employment and 17% reporting increases. 64% reported steady employment

- the prices paid index fell to the lowest reading since September 2020 and is near its long-run average

- the six-month forward business activity returned to positive territory which is its first since May

For the full report click here