If you're in financial markets, you've probably seen some version of this chart in the last day. It's all over twitter and they've been referencing it on CNBC all day.

It's a chart of new US homes for sale, shown in the number of months' supply.

It's easy to take it and draw parallels to the US housing collapse and because we're in an era where sensationalism and doom are amplified, it's everywhere right now.

The bears have it wrong.

There's a fundamental shift in how homebuilders are selling homes. Because of supply chain issues and inflation, they're waiting until later in the cycle to price homes. It's also taking longer to build homes and consumers are wary of committing until they have firm move-in dates.

The reality is that most of the homes counted as supply are still under construction. They're not sitting there with a 'for sale' sign on the door and ready to move in.

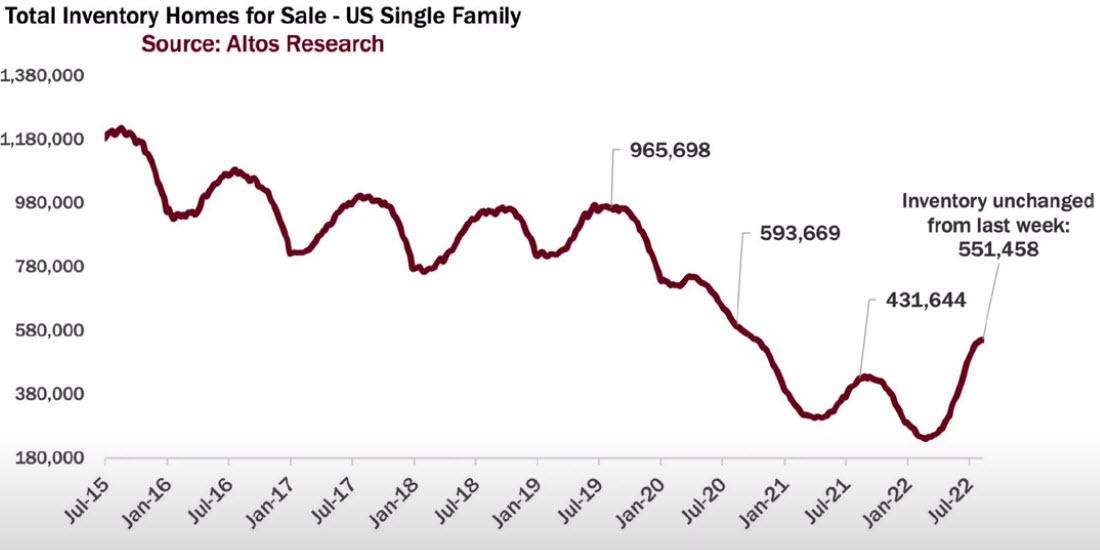

This is the counter-point: It shows all the single-family homes for sale in the US. It shows a rise in inventory but it's still far below pre-pandemic levels.

So what the bears are trying to say is that the inventory of new homes for sale are at crisis levels but the total inventory of homes for sale is half of July 2015 levels? That makes no sense.

But don't take my word for it. Here is the CEO of Toll Brothers (8th largest US home builder) today on the conference call:

To be sure, there is a genuine softening in demand for US housing. The spike in mortgage rates in the last six months has pushed many buyers to the sidelines.

From Toll Brothers:

As our third quarter progressed, we saw a significant decline in demand as many prospective buyers step to the sidelines in the face of steep increases in mortgage rates, significantly higher home prices, a volatile stock market and rising inflation. Buyer confidence was also impacted by the nonstop headlines about a softening housing market and by a general sense of uncertainty regarding the future direction of the economy. All of these factors led to a market change in psychology, and buyers remain cautious through the summer months. As a result, our net signed contracts were down approximately 60% in units compared to last year's historically strong third quarter.

There's also extra supply. During the pandemic frenzy, home builders likely started as many projects as they could. Margins are still sky high for those homes with prices where they are.

Moreover, since rates stabilized in the past month or so, Toll Brothers reported buyers returning:

In more recent weeks, we have seen signs of increased demand as sentiment appears to be improving and buyers are returning to the market....From the fourth of July forward, we started seeing signs of better traffic. We survey our 350 sales teams around the country every week. I'm involved in calls on -- for hours every Monday, and we started hearing the traffic is better. They're interested, they're back, they've absorbed the new market. Summer is moving on. They're starting to think through their plans.

What I believe happened is that that rapid jump in rates caused a shock to would-be buyers. That led to a bit of a buyers' strike but people who want to buy a home still want to buy a home. If a 30-year fixed can stay close to 5%, they will adjust. Home builers also sold through the pandemic with extremely high margins because demand was so high, they are now bringing back incentives and discounts, which will help to bridge the affordability gap.

Finally, with the months supply that doesn't just show supply. The denominator of 'months' shows how much buying their was. The buyers' spike and subsequent strike created a bullwhip effect that's creating a false signal. That won't last with rent prices increasing, millenials entering prime household formation years, private equity not losing its appetite for rental homes and years of underbuilding.