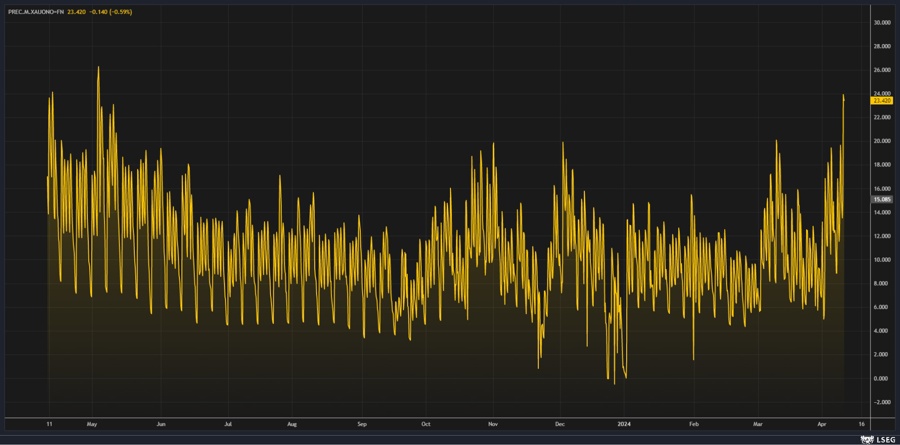

Overnight volatility for gold has jumped to 23%, which is the highest since May 2023.

Given the recent run higher in gold it shouldn't surprise that markets are getting a bit uncertain heading into CPI.

We spoke about this yesterday as well, but it's worth flagging again that the options market is getting a bit cautious of the recent run higher.

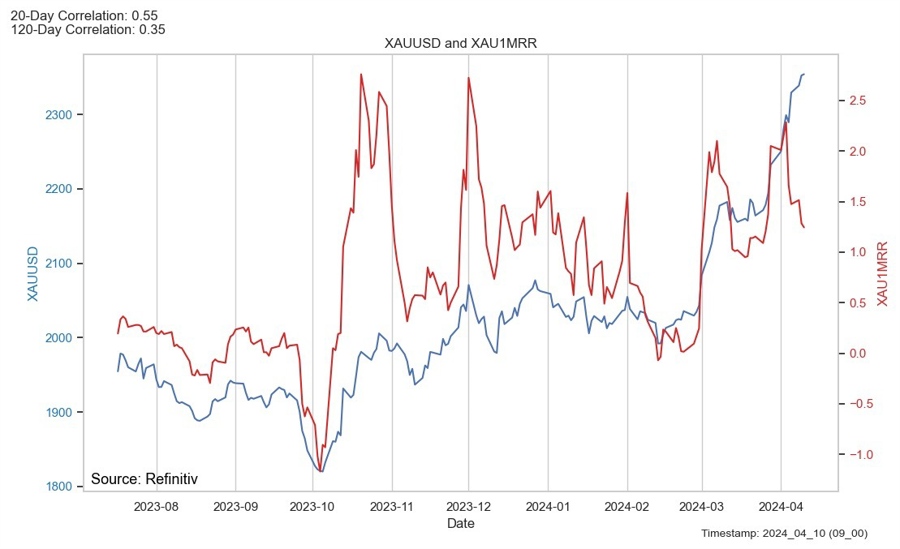

Below we can see that while spot (blue) have continued to grind higher, risk reversals (red) have pushed lower by quite a bit (showing more put activity).

Hence a beat in CPI today might offer short-term traders the best bang for their buck.

However, a lot of the recent upside in commodities has been attributed to inflation risks. Thus, even though a beat in US CPI could see short-term pressure, it could also see more hedging activity kicking in.

Bottom line is approach this one with caution.