The TL;DR:

- Morgan Stanley expects CPI to confirm firm inflation pressures

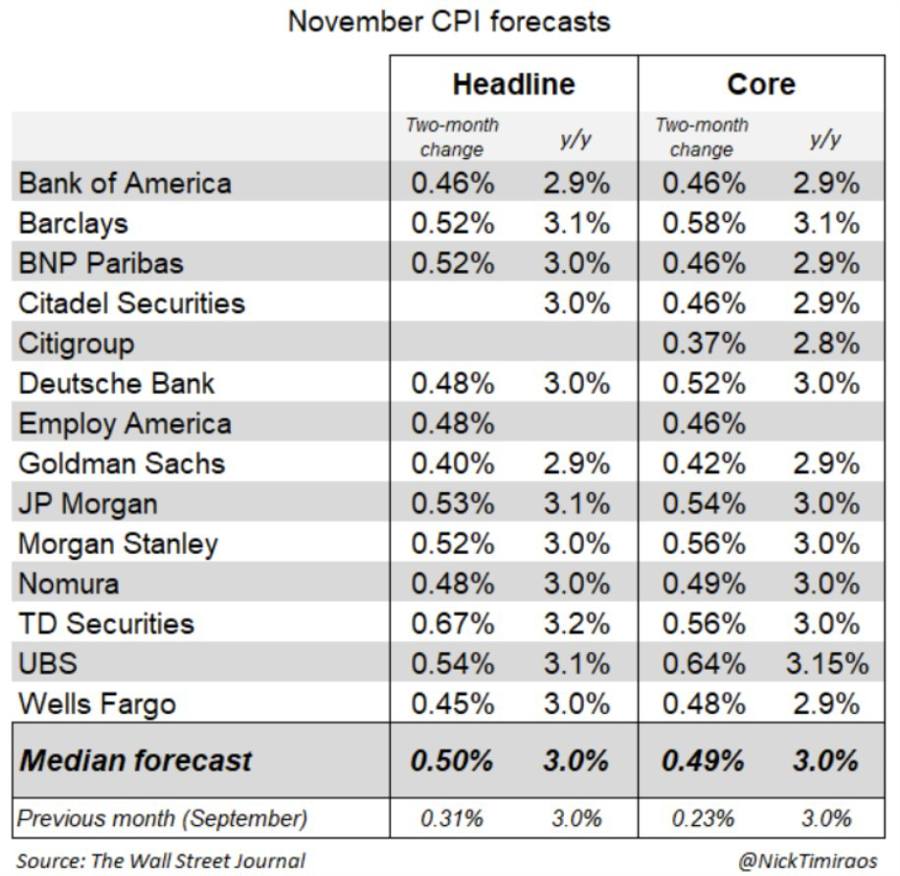

- Core CPI seen near 3.0% y/y in November

- Shelter and goods prices remain resilient

- Data limitations reduce monthly detail

- Supports cautious Fed policy outlook

U.S. consumer price data due on Thursday, December 18, is expected to confirm that underlying inflation pressures remain firm, according to Morgan Stanley, even as data limitations complicate interpretation of the latest release.

In a note previewing the report, Morgan Stanley said it expects core inflation to show continued resilience, driven by a rebound in shelter costs and ongoing firmness in goods prices. The bank estimates that core CPI inflation averaged around 0.28% month-on-month across October and November, a pace that would lift core inflation to roughly 3.0% year-on-year in November.

Headline inflation is also expected to remain elevated, averaging around 0.26% m/m over the same two-month period, reflecting similar underlying strength. Morgan Stanley said these readings point to persistent inflation momentum that remains inconsistent with a rapid return to the Federal Reserve’s 2% target.

However, the November CPI release comes with an important caveat. Due to the government shutdown, individual monthly prints for October and November will not be published. Instead, markets will receive only a November price level, significantly reducing transparency around month-to-month inflation dynamics. While this limits granularity, Morgan Stanley said the broader signal still points to firm underlying pressures.

Shelter inflation is expected to rebound after a period of moderation, reflecting the well-known lag between market rents and official inflation measures. Goods prices, which had previously contributed to disinflation, are also expected to remain resilient, suggesting that inflation pressures are not confined solely to services.

Morgan Stanley cautioned that the lack of detail may temper market reactions at the margin, but said the overall message should reinforce the Federal Reserve’s cautious approach to policy easing. With core inflation tracking around 3%, the data are unlikely to provide policymakers with the confidence needed to signal an imminent shift toward rate cuts.

In Morgan Stanley’s view, even a technically constrained CPI release is likely to validate the narrative that inflation remains sticky, keeping pressure on the Fed to maintain a restrictive stance into early 2026.

-

Meanwhile, the Wall Street Journal have published their survey of expectations:

The Journal's noted Fed watcher, Nick Timiraos with his summation: