Shares of United Airlines are up 1.8% today after earnings. UAL stock of off the record high set earlier this month by about 8% but airlines continue to offer an interesting window into the real economy.

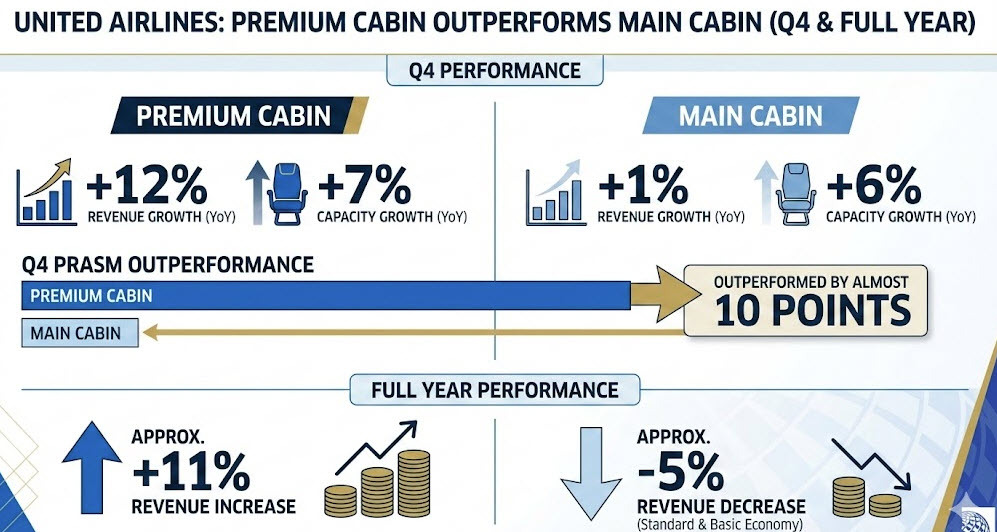

Similar to Delta Airlines (who reported last week), virtually all the growth was in the premium end of the plane.

For the year, premium revenues increased approximately 11%, while standard and Basic Economy revenues were down approximately 5%. The trend was the same in the fourth quarter. The trend isn't just premium improving while the lower classes stay flat, basic economy revenues fell despite a 6% increase in capacity.

That's a stark reminder that two different economies are operating in the United States at the moment.

For the airline industry in particular, the loyalty business is a booming one. Airlines basically pioneered the loyalty industry and United highlighted that revenues were up 9% and payments from global co-brands were up 12%. There is a saying in airlines now that they're loyalty businesses with planes attached to them.

Looking ahead, the company highlighted strong bookings.

Based on what we've seen so far this year, bookings and yields are outpacing the strong start from last year, and we're hopeful that the momentum will continue, which could admittedly cause our guidance to feel a bit conservative.

The company also noted strong business booking so far this year, which is a good sign for the economy.

Another notable ongoing shift for airlines is that travel is being spread out across the year. Where it was once families and workers traveling on holidays and in the summer, it's now wealthy baby boomers who are traveling on off-peak times. That allows airlines to smooth out capacity and operate more efficiently.

Looking to the first quarter at United, they expect earnings per share to be between $1 and $1.50, an approximately 37% earnings improvement versus the first quarter of last year. Building off a strong quarter for the full year 2026, they expect earnings per share to be between $12 and $14. At the midpoint, this represents over 20% growth and implies continued margin expansion as we march towards double-digit margins.

In 2025, the company generated $2.7 billion in free cash flow and, in 2026, they expect to deliver a similar level of free cash flow despite higher aircraft deliveries. That's a 7.7% FCF yield on a $35 billion market cap. The company plans to deleverage and invest in aircraft until the end of the decade, when it will then be in an enviable position. The company has been buying back shares and has $782 million left in its authorization.

In terms of investment, CIBC is out with a note on how they expect large carriers to chew up discount airlines.

We expect carriers with higher exposure to premium, corporate, and loyalty-driven demand to demonstrate greater resilience in yields and margins in 2026, relative to leisure-focused peers.

That sounds like United and chief executive Scott Kirby said something similar:

I think the structure of the industry is ultimately going to be low-cost carriers will shrink down to the niche that works for low-cost carriers. That is big leisure markets. And I don't know if they're going to liquidate, if they're going to merge, if they're just going to all shrink, for sure. But they're going to shrink down to the niche that works.

He was also ruthless in some comments about American Airlines and the battle for dominance in Chicago. He highlighted that United's focus on loyalty has vaulted it far ahead of American, and that its competitor will lose $1 billion at the hub this year, despite big investments to try and get market share.

I think there's going to be 2 brand-loyal airlines [UAL and DAL]. That's already the case. I gave you the numbers in Chicago. That game is over. I realize that not everyone knew the game was on. The game is over. And when we have that big of a lead with customers, like you just don't win it back because you'd have to have technology, product and services that were somehow better than United and somehow better than Delta to even start. And you're a decade behind.

That kind of competitive spirit is good for consumers.