- Prior was 58.0

- Manufacturing 57.8 vs 58.5 expected -- lowest since Dec 2020

- Prior manufacturing 58.3

- Manufacturing input prices at lowest since May

- Services input prices 77.4 vs 75.7 prior -- highest since series began in 2009

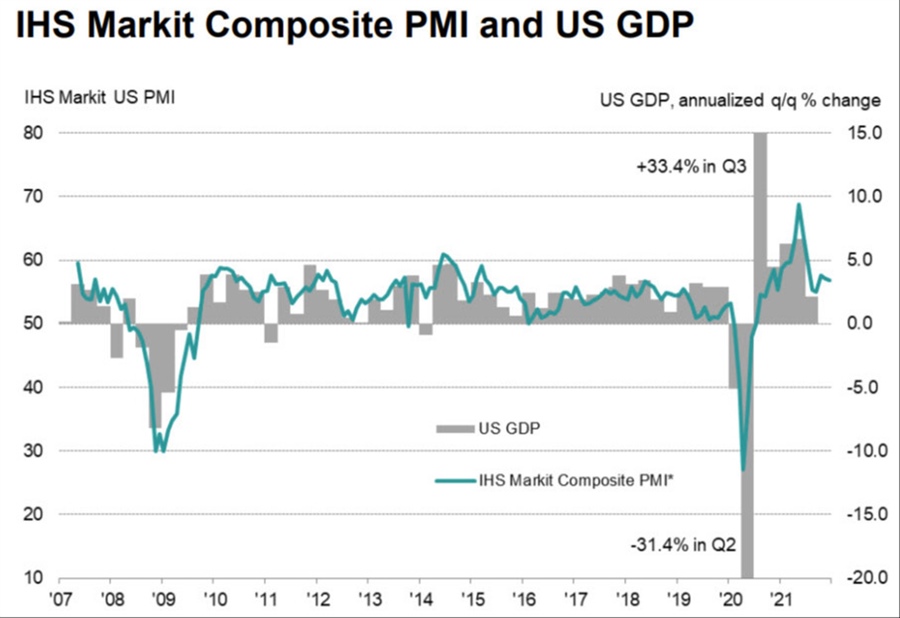

- Composite PMI 56.9 vs 57.2 prior (shown above)

- Composite input prices at series high

The dip in manufacturing input prices is notable. Perhaps that's simply the decline in energy prices but it's an interesting development because the prices numbers in the Empire Fed also fell in December. Did the Fed blink just as inflation was about to prove them right?

Commenting on the PMI data, Chris Williamson, Chief Business Economist at IHS Markit, said:

“The survey data paint a picture of an economy showing encouraging resilience to rising virus infection rates and worries over the Omicron variant. Business growth slipped only slightly during the month and held up especially well in the vulnerable service sector. Manufacturing output growth even picked up slightly amid a marked easing in the number of supply chain delays, which also helped to take pressure off raw material prices. Barring the initial price slide seen at the start of the pandemic, December saw the steepest fall in factory input price inflation for nearly a decade. “The worry is that rising wage growth, greater transport costs and higher energy prices have pushed service sector cost inflation to a new high, and that any renewed disruption to global supply lines resulting from the Omicron wave could lead to renewed upward pressure on goods prices.”