It's going to be a light week ahead as we're heading into the winter holidays. The main events will be the BoJ policy rate and press conference on Tuesday, followed by Canada's inflation data and the U.S. CB consumer confidence and existing home sales Wednesday. On Thursday we have the U.S. unemployment claims and Friday the Canadian GDP m/m and the U.S. core PCE price index m/m, durable goods orders m/m and new home sales.

Last week, the FOMC raised the Fed funds rate by 50bps, slowing the pace of tightening, but the tone was still hawkish suggesting that the fight against inflation is not over and that the rate might need to remain elevated for some time. Inflation data for the U.S. economy has shown signs of cooling down in November, but retail sales and industrial production fell below expectations, signalling economic conditions could worsen.

The ECB, BoE and SNB also announced 50bps hikes last week and the ECB expects to start quantitative tightening in March. The question on everyone's minds is if central banks will start cutting interest rates next year or will hold them at current levels. While there are some signs of inflation cooling down, banks must ensure these are not temporary and not risk acting too soon. Some analysts have overtightening fears, especially for the Fed, and this will probably be the theme for the next year.

For this week's BoJ meeting, the monetary policy and the YCC are likely to remain unchanged, as Governor Haruhiko Kuroda only has a few meetings left until his mandate ends. The focus will be on his remarks about the inflation outlook.

Inflation in Japan has grown more elevated than analysts anticipated, and some economists expect a change in monetary policy from the future Governor. According to Bloomberg, Japan's Prime Minister Fumio Kishida plans to revise the decade-old accord with the BoJ regarding the 2% price goal, making it more flexible.

Inflation for the Canadian economy has peaked according to some analysts, but prices are still elevated, and the BOC could maintain its tightening policy until there's a clear sign that inflation is cooling down.

U.S. housing starts and existing home sales are expected to decelerate further. The housing market is under pressure due to the quick rise in mortgage rates this year and it's likely to remain negatively impacted for a longer period. Consequently, houses have become inaccessible for many potential buyers and the number of single-family building permits fell for eight consecutive months. Even if new home sales registered an uptick in October, with builders offering some incentives, it's likely they'll decline in November as the pressure from elevated mortgage rates is too high. According to Scotiabank housing trends are seen as a key variable for the U.S. monetary policy outlook.

The PCE (personal consumption expenditures) index, which is the Fed's preferred measure of inflation, is likely to come above expectations. Consumers have managed to keep up with rising inflation so far, but there are signs the lower purchasing power is starting to have an impact, especially in retail sales which printed lower than expected in November.

USD/CAD expectations

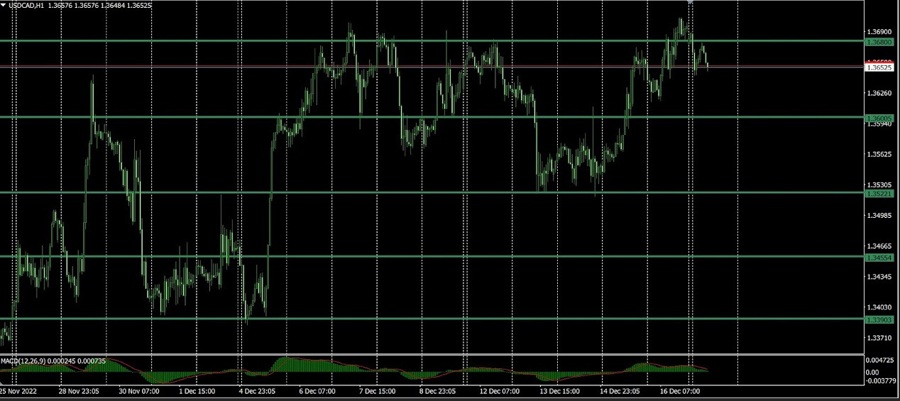

On the H1 chart the pair closed the week above the 1.3680 level of resistance. A correction is expected until 1.3600 which is the next level of support. If that holds, the next target could be 1.3740 or even 1.3800. On the downside the next level of support is at 1.3520 and 1.3455.

A risk for this trade is the CPI data for the Canadian economy and the GDP report. The outlook for USD/CAD is bullish this week, but many traders are preparing for the holidays so the pair might have a choppy direction due to low liquidity.

This article was written by Gina Constantin.