The upcoming week in the FX market is expected to be relatively quiet, with only a few economic events on the calendar.

On Monday, the OPEC Joint Ministerial Monitoring Committee (JMMC) is set to hold meetings. The focus of these meetings will be on current market conditions, and investors will be keeping a close eye on any developments that may impact the oil market. Also on Monday, the ISM Manufacturing PMI data will be released for the United States.

On Tuesday, the RBA will release the cash rate and rate statement and in the U.S. we'll get the JOLTS job openings data and durable goods report. Wednesday will see the release of the cash rate and rate statement from the RBNZ. Additionally, RBA Governor, Philip Lowe, will speak at the National Press Club in Sydney. Later in the day, we'll get the U.S. ADP Non-Farm Employment Change and the ISM Services PMI data.

On Thursday, Canada will release its employment change and unemployment rate data, while the United States will get the weekly unemployment claims.

Friday will be a bank holiday in many countries, but not in the U.S., where we'll see the release of the average hourly earnings , non-farm employment change and unemployment rate data.

It's also worth noting that on Sunday, OPEC surprised the market with a voluntary cut of 500,000 barrels per day, making the upcoming OPEC-JMMC meetings even more crucial for investors.

There is currently a split in analysts' opinions regarding the next move of the RBA, with some suggesting that the bank will continue its hiking cycle, while others believe that it may pause. The latest CPI data shows that inflation may have peaked, and as a result, the RBA may pause its hiking cycle to observe how its current monetary policy takes effect before deciding whether further hikes are necessary.

The economic data for Australia has been mixed lately, with some conflicting reports. On one hand, there has been strong labor market data, but on the other hand, the March PMI indicated a decline in sentiment while retail sales only showed marginal gains. Overall, the data suggests that a slowdown in economic activity is likely, making it plausible for the RBA to pause at its next meeting.

The RBNZ is anticipated to raise the interest rate by 25bps at this week's meeting. As the hike appears to have been already priced in, the meeting may be uneventful if the Governor does not provide any fresh information. The Bank is committed to fighting inflation and might continue to hike rates until there's evidence that inflation has peaked. Traders will be on the lookout for any signals of a potential pause, given that New Zealand's economy is also likely to slow down.

RBNZ Chief Economist Paul Conway also made remarks emphasizing that the policy rate is now above neutral and started to have the desired contractionary impact, which is reflected in the slowing demand. Nevertheless, inflation in New Zealand remains an issue, currently standing at 7.2%, so further rate hikes may be necessary, and analysts argue that another 25bps hike may be possible at the May meeting, bringing the peak to 5.25%.

U.S. ISM manufacturing and services data this week might not fully reveal the effects of the recent stress in the banking sector on the economy, it remains a significant indicator to monitor. The ISM services index is expected to remain in positive territory, with a projected value of 54.5, while the ISM manufacturing index is predicted to decline for the fifth consecutive month, with a projected value of 47.3, according to Wells Fargo analysts.

Due to market holidays, Canada's employment change and unemployment rate data will be released one day earlier. The unemployment rate is anticipated to increase from 5.0% to 5.1%, while employment change is expected to rise by 10.5K.

The release of NFP data on Friday might not have a big impact in the market given the bank holiday in many countries. The consensus is for 235K new jobs added, with average hourly earnings m/m expected to rise by 0.3% and the unemployment rate to remain unchanged at 3.6%. Weekly jobless claims remained under 200K, indicating that the labour market is still tight.

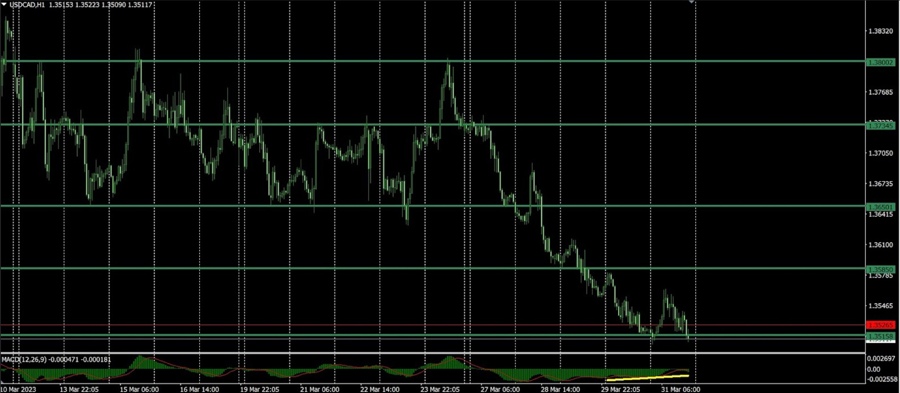

USD/CAD expectations

The pair closed the week around the 1.1315 level of support and a correction is expected until the 1.3650 resistance. If that level holds, the next target could be the support at 1.3450. In terms of fundamentals, the week is relatively quiet for the USD/CAD, with labour market data in focus. The data for Canada will be released on Thursday due to Good Friday, while for the U.S., it will be released on Friday.

Another thing worth mentioning is that seasonals are strong for the CAD in April and, according to Scotiabank analysts, April is typically the strongest month for the CAD against the USD, as the USD has weakened approximately 75% of the time during this month over the past 20 years. Furthermore, the average USD return in April since 2002 has been slightly over -1%.

On the upside the next levels of resistance are at 1.3735 and 1.3800.

This article was written by Gina Constantin.