US stocks opened lower on the back of the Israel/Hamas bombing over the weekend. However, momentum faded and the indices started to reverse higher. Although the US bond market was closed, US bond futures did rally (lower yields), implying a decline in yields (flight to safety flows).

Fed officials, although concerned about inflation, did comment that rate rises were tightening for the Fed. The expectations for a rate hike moved lower:

- 14% in NOvember vs 16% earlier today (and above 30% on Friday)

- Price of cut moved to June 2024 vs July earlier today

A snapshot of the closing level shows:

- Dow industrial average up 197.05 points or 0.59% at 33604.64

- S&P index up 27.16 points or 0.63% at 4335.65

- NASDAQ index up 52.89 points or 0.39% at 13484.23

Looking at the NASDAQ index chart below, it is inching closer to its 100-day moving average at 13581.89 currently. Back on September 20 the price closed right near the 100-day moving average (blue line on the chart below), but gapped to lower on the very next day. The price has not been above the 100-day moving average since then.

A move above the 100 day moving average (blue line in the chart below) this week is needed to increase the bullish bias from a technical perspective. Staying below, would keep the sellers in play.

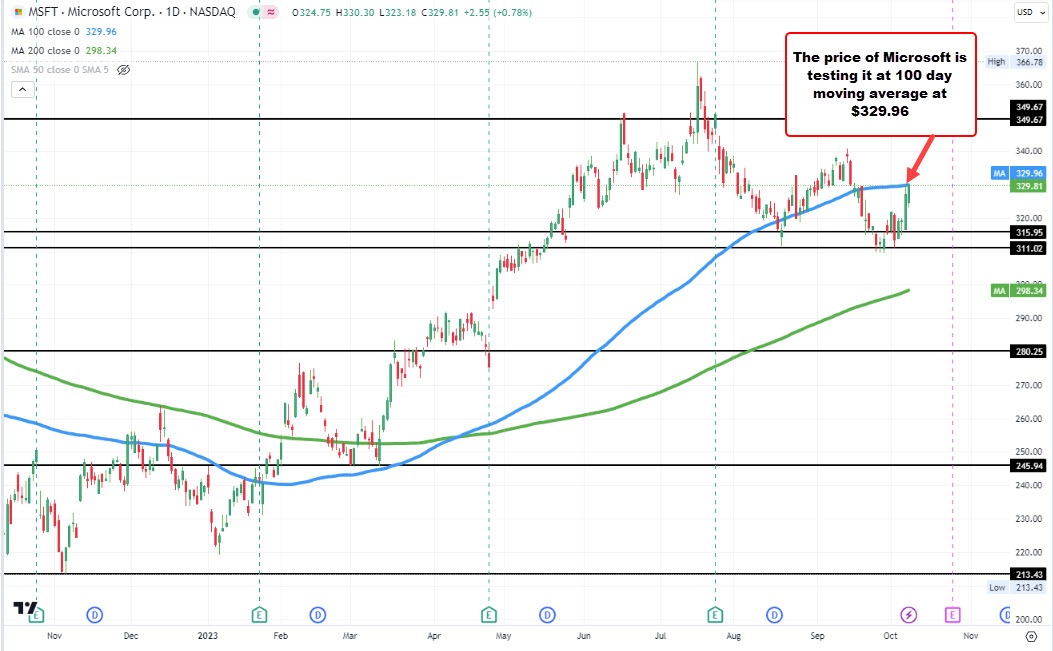

Of note is Microsoft shares tested its 100-day moving average at $329.96 (see chart below), and is closing just below that level at $329.82. A push above Microsoft's 100-day moving average tomorrow, could give the NASDAQ index the needed momentum to make its run at the same moving average as well.