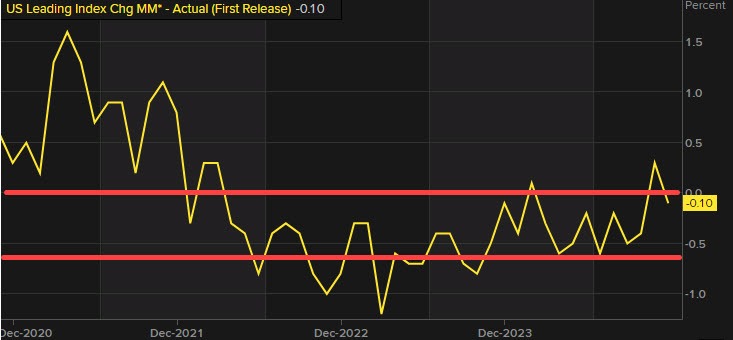

- Prior month revised higher to 0.1% from -0.1% last month

- Leading index for January -0.3% versus -0.1% estimate

Most Popular

Nexperia's $8B dispute sparks chip shortage fears. Dutch block China control, impacting auto supply.

Gas prices jump 14% in a week! Iran conflict fuels surge, hitting wallets pre-spring break.

Micron's stock plunges 10% on weak guidance, raising valuation concerns for chipmakers.

Dividend Kings boast 50+ yrs of hikes, offering safe income. AI bubble fears? Seek value.

AVGO's AI boom fuels 100B forecast, challenging Nvidia's dominance. Buy signal?

US inflation data shows mixed signals: core CPI may ease, but core PCE remains sticky at 3% YoY.

Asian/EU gas prices surge 55-70%, oil up 15-20% amid Iran conflict. Policymakers eye price mechanisms, domestic investment.

Must Read