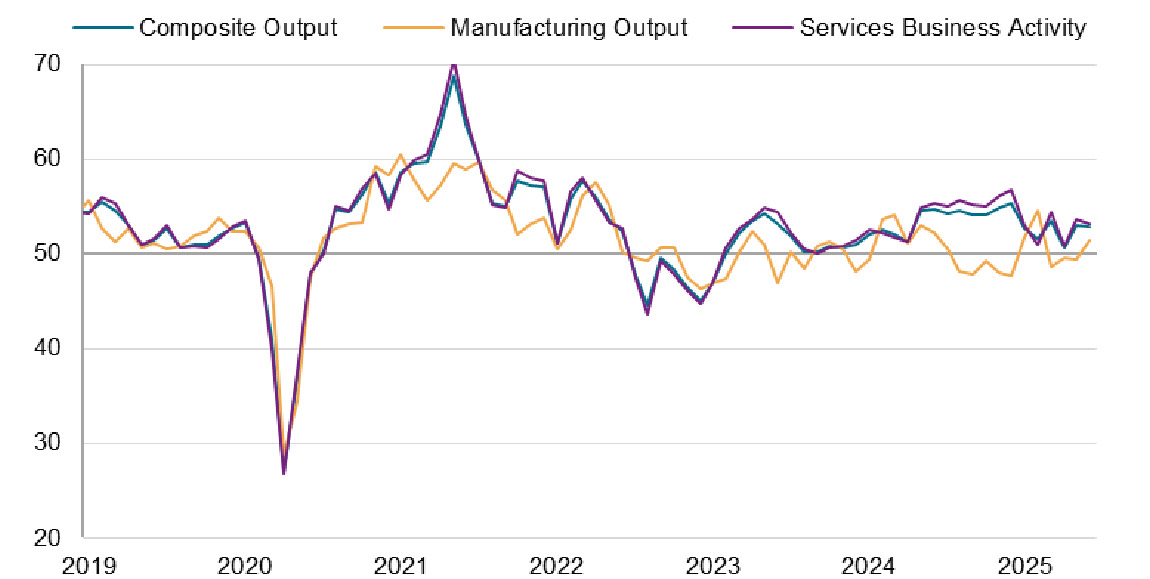

- Prior was 53.7

- Manufacturing 52.0 vs 51.0 expected

- Prior manufacturing 52.0

- Composite 52.8 vs 53.0 prior

- Price pressures rose sharply across both manufacturing and service sectors during June

- Services exports have suffered the largest quarterly contraction since late 2022 in the three months to June

- June saw further inventory building in manufacturing

- Manufacturing companies took on additional staff at a rate not seen for just over a year largely

These numbers are a tad above expectations but still slowed slightly on the aggregate.

Commenting on the flash PMI data, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence said:

“The June flash PMI data indicated that the US economy continued to grow at the end of the second quarter, but that the outlook remains uncertain while inflationary pressures have risen sharply in the past two months. Although business activity and new orders have continued to grow in June, growth has weakened amid falling exports of both goods and services. Furthermore, while domestic demand has strengthened, notably in manufacturing, to encourage higher employment, this in part reflects a boost from stock building, in turn often linked to concerns over higher prices and supply issues resulting from tariffs. Such a boost is likely to unwind in the coming months. Prices for goods have meanwhile jumped sharply again, the rate of increase accelerating to a three year high as firms pass higher tariff-related costs on to customers. Service providers are by no means immune to this tariff impact and likewise reported another jump in prices, often linked to tariffs on inputs such as food. The data therefore corroborate speculation that the Fed will remain on hold for some time to both gauge the economy’s resilience and how long this current bout of inflation lasts for.”

That commentary is worrisome but it's not something that will startle the market as all of these factors are already been well covered, though still a big source of uncertainty in terms of how hard they will hit. Market moves have been minimal.