Prime Minister Sanae Takaichi may be looking to capitalize on high personal approval ratings and a honeymoon period to consolidate power in the lower house.

A Yomiuri report says she's mulling dissolving the lower house for a snap election in mid or mid-February. Takaichi became the first woman ever to lead Japan's dominant ruling party after winning leadership of the party in October and was sworn in as Prime Minister later that month.

However she leads an LDP-Ishin minority after long-time coalition partner Komeito withdrew support due to Takaichi's hawkish views. Her ability to pass legislation is limited so she may be trying to be the first Japanese woman to win an election as Prime Minister, validating her position and consolidating power.

She is polling well right now so this isn't a big surprise but she has an ambitious agenda and will need a stronger position in parliament to pass it. If dissolved, all 465 Lower House seats become vacant and a general election must be held within 40 days.

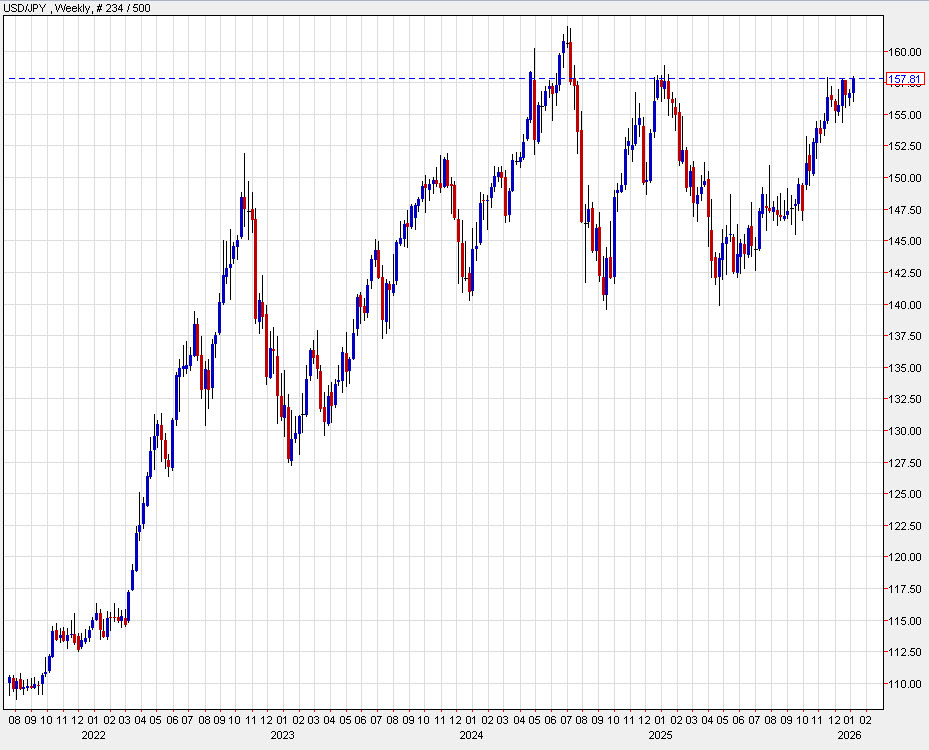

A big factor in the election may be the yen, which struggled badly in the second half of 2025 and is flirting with a 9-month low today.

The USD/JPY chart also flatters the yen's performance as it hit a record low recently against the euro and the worst levels since the 1990s against the pound.

That weakness helps Japanese export competitiveness but it's a dangerous game to play with imported inflation. Japanese bond markets are also increasingly vulnerable. Long-term borrowing costs have spiked to the highest in decades.

If Takaichi runs on increasing spending and wins the support to do that, we could see even more selling in Japanese bonds, something that risks a spiral and a crisis that could spread across borders.

Watch Japan very closely this year.

The number one risk I see in the foreign exchange market in 2026 is Japan. The yen has been struggling for the past six months and it’s close to a boiling point in Tokyo. There were some stronger warnings about FX intervention late in December. Japan is the most-indebted major economy in the world and the demographics are terrible. The US is leaving a lot of uncertainty around its alliance with Japan and China is eating its lunch in manufacturing.

There is something of ‘boy who cried wolf’ situation around Japanese debt as people have been calling for a crisis for 20 years but Japanese borrowing costs are hitting 30 year highs. These things can escalate quickly and could turn into an international problem.