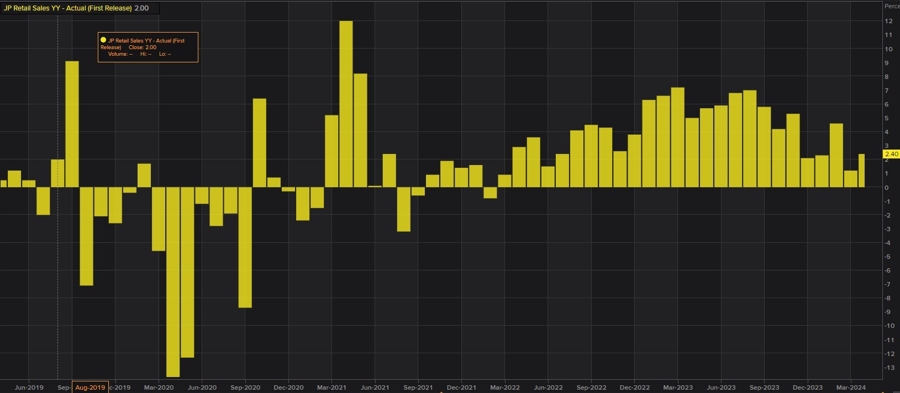

- Japan retail sales YY: 3.0% vs 2.0% expected

- Japan large scale retail sales YY: 4.0% vs 3.0% prior

Most Popular

Qatar LNG halt sparks 52% TTF surge, but long-term impact limited. Watch for 4.3% output drop.

Oil spikes 6% on Mideast tensions; Dow drops 1000 pts. KEYS dips 5.4%, still up 38% YTD.

Oil jumps 16% on supply shock fears, sending Dow down 800 pts. Inflation worries rise.

Nvidia exits AI giants' stakes; $30B OpenAI, $10B Anthropic deals close as IPOs loom. Risk vs. reward shifts.

LRCX drops 4.5% on Mideast supply risks & AI chip restrictions. Is it a buy?

800/mo car payments sink sales! Negative equity plagues buyers & dealers. Watch auto sector valuations.

US chip export rules may tighten, hitting NVDA & AMD. AVGO gains on strong earnings.

Must Read